What is Fatca

The US, the Philippines, North Korea, Libya and Eritrea are some of the countries which charge a tax on the global revenue of their citizens and residents

The United States (US) is the only major country that applies a tax on the worldwide income of its citizens and tax residents. The other countries which charge a tax on the global revenue of their citizens and residents are the Philippines, North Korea, Libya and Eritrea.

If they are living abroad and earning any income, the US citizens are liable to submit the annual tax return to Internal Revenue Service (IRS). In addition, the US taxpayers who own foreign accounts are responsible for reporting those accounts to the US treasury department.

To avoid tax evasion, the US government introduced the Foreign Account Tax Compliance Act (Fatca) in 2010, which requires Foreign Financial Institutions (FFIs) to report information about financial accounts held by US taxpayers or by foreign entities in which US taxpayers have a substantial ownership interest. Unless exempt, FFIs that do not comply with the Fatca, 30 per cent withholding tax applies to their US source payments made to them.

FFIs can submit this information directly to the IRS by logging in to their portal or through the competent authority of the respective country where the Intergovernmental Agreements (IGA) are in place. Including China, 113 jurisdictions have signed the IGA to comply with Fatca, and the UAE is one of them.

The UAE signed IGA with the US government (US-UAE IGA) on June 17, 2015. Being a competent authority, the Ministry of Finance in the UAE, issued guidance on the UAE IGA on July 6, 2015.

In the IGA, both of the parties have agreed that the UAE will collect and exchange the information on each “US Reportable Account” on an annual basis with the US relevant authority, and the US Reportable Account has been defined as under in the IGA: “Financial Account maintained by a Reporting UAE Financial Institution and held by one or more Specified US Persons or by a non-US entity with one or more controlling persons that is a specified US person”.

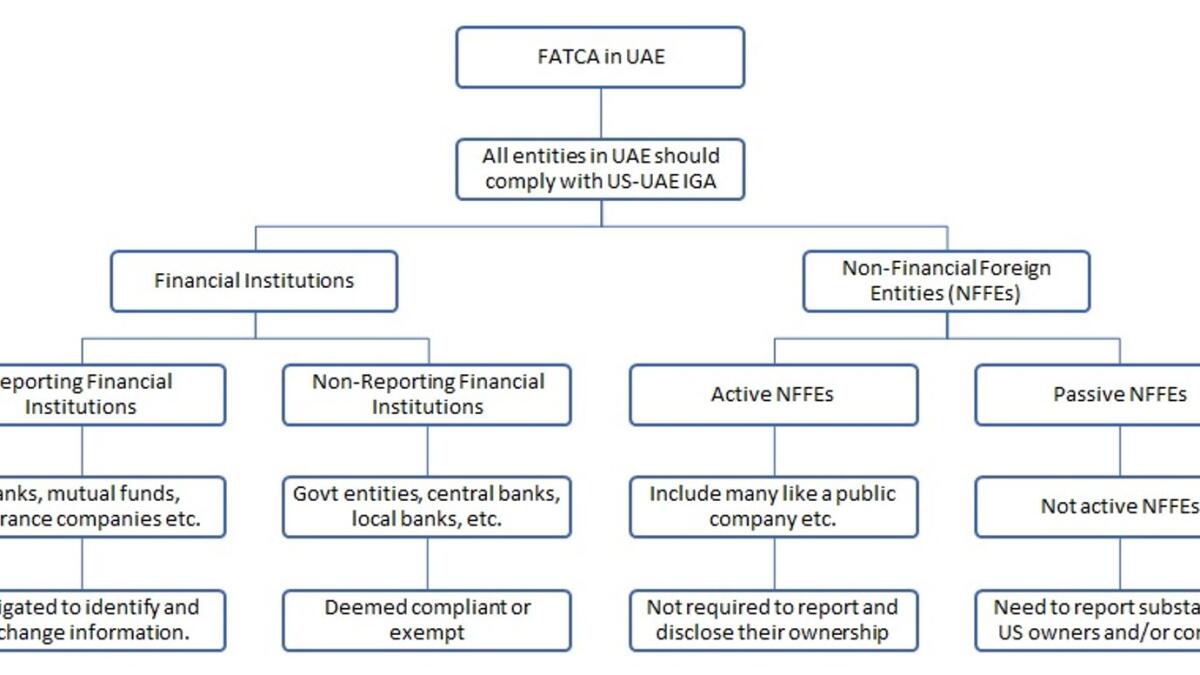

Under the UAE Law, all entities within the UAE should comply with the US-UAE IGA, and the entities can be classified into (i) Financial Institutions (FIs) and (ii) Non-Financial Foreign Entities (NFFEs).

FIs can be categorised as (i) Reporting FIs, and (ii) Non-Reporting FIs. Each reporting FI shall be treated as complying with Fatca, and 30 per cent tax will not be held on the US source payment if the related information has been provided by the UAE government within the due date and the reporting FI comply certain conditions. Each non-reporting FI shall be deemed compliant or exempt beneficial owner.

Non-reporting FIs are generally not required to report information to the UAE; however, they will need to provide properly completed US tax forms or self-certifications to avoid Fatca withholding on US source payments to them. The key example of non-reporting FIs as given in the annexure-II of US-UAE IGA are government entities, intergovernmental organizations, central bank, FIs with a local client base, local bank, FI with only low-value accounts etc.

Non-US entities that are not FIs are considered to be Non-Financial Foreign Entities (NFFEs) which can be classified as (i) Active NFFEs and (ii) Passive NFFEs.

An “Active NFFE” means any NFFE that meets any of the criteria like less than 50 per cent of their gross income is passive income and less than 50 per cent assets are held to produce passive income, the stock of the NFFE is regularly traded on an established securities market or the NFFE is a related entity of an entity the stock of which is regularly traded on an established securities market, the NFFE is a government or part of the government, the NFFE is organised in a US territory and all of the owners of the payee are bona fide residents, of that US territory; etc.

All active NFFEs doesn’t require any Fatca reporting but properly completed US tax forms or self-certification is required in order to avoid Fatca withholding on US source payments to them. Any NFFE which is not active will be considered passive NFFE. All passive NFFEs are required to identify and exchange information about their substantial US owners and/or controlling persons who are specified US persons.

Regulated entities will be regulated by their regulators. All economic department entities will be governed by the Federal Ministry of economy, and all freezone entities will be managed by the respective freezones authorities for the compliance and enforcement of Fatca.

Source:https://www.khaleejtimes.com/finance/what-is-fatca

What are deferred tax liabilities

Deferred tax liabilities are the amounts of corporate taxes payables in future periods

In our previous article titled “difference between accounting and taxable profits”, we established that the difference between accounting and taxable profits could be of permanent and temporary nature.

Moreover, we discussed that temporary differences, which create lower taxable profits in the current period, occur due to taxable temporary differences and ultimately, it creates deferred tax liabilities.

Deferred tax liabilities are the amounts of corporate taxes payables in future periods, and this arises due to the following factors:

• Taxable revenue is lower than accounting revenue due to taxable temporary differences.

• Taxable expenses are higher than accounting expenses due to taxable temporary differences.

The tax authorities may allow businesses to pay tax on lessor income than the income booked in the statement of comprehensive income, which leads to lower taxable profits. Like interest of Dh50,000 on fixed-term deposits accrued by the A Ltd which will be received at the end of the deposit term of five years. Tax authorities will not consider this accrued interest as an income while calculating taxable profits of the current period, and the taxable temporary difference will arise due to this interest income.

In the cases where taxable expenses are higher than the accounting expenses, the typical examples are prepayments, like three years rent of Dh120,000 paid in advance. In the accounting books, it will be amortised over three years at the rate of Dh40,000 per year, while tax authorities in various jurisdictions may follow a cash basis and can ask the registered business to treat full rental payment of Dh120,000 as allowable tax expense in the first year. So, in the current period, taxable expenses would be higher by Dh80,000 due to prepaid rent.

Source:https://www.khaleejtimes.com/finance/what-are-deferred-tax-liabilities

What are deferred tax assets

The tax authorities may ask businesses to pay tax on more income than the income booked in the statement of comprehensive income, which leads to more taxable profits

In our previous article titled “difference between accounting and taxable profits”, we established that the difference between accounting and taxable profits could be of permanent and temporary nature. Moreover, we discussed that temporary differences, which resulted in higher taxable profits, arose due to deductible temporary differences and ultimately, it would create deferred tax assets.

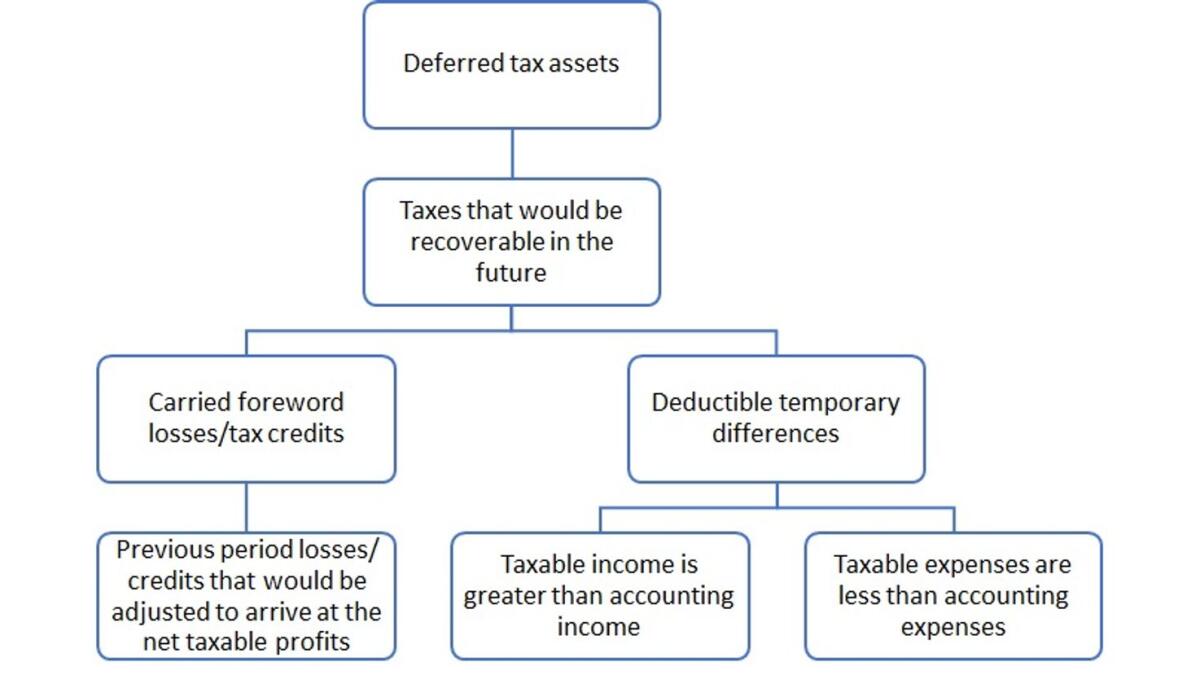

Deferred tax assets are the amounts of corporate taxes recoverable in future periods, and this arises do to the following factors:

• Taxable revenue is greater than accounting revenue due to deductible temporary differences.

• Taxable expenses are less than accounting expenses due to deductible temporary differences.

• The business has carried forward tax losses/tax credits

The tax authorities may ask businesses to pay tax on more income than the income booked in the statement of comprehensive income, which leads to more taxable profits. Like three years rent of Dh120,000 received in advance. In the accounting books, it will be amortised over three years at the rate of Dh40,000 per year, while tax authorities in various jurisdictions may follow a cash basis and can ask the registered business to treat full rental receipt of Dh120,000 as taxable income in the first year. [advances would not be subject to corporate tax in the UAE, so deferred revenue due to advances would not create any deductible temporary difference].

In the cases where taxable expenses are less than the accounting expenses, the typical examples are provision for warranties, bad debts, research and development costs, legal costs, etc. Registered businesses may book expenses on an estimated and/or provisional basis, while tax authorities may allow expenses on a cash basis. For example, A Ltd, based on the past experience, expects that three per cent of the total sales of Dh100,000 will be returned for repair in the next year and creates provision of Dh3,000 [100,000*3%]. This means A Ltd booked a liability for accrued product warranty costs by debiting expenses and crediting provision for the warranty. This provision for the warranty services may not be accepted by the tax authorities, and they may not allow related costs, which will lead to higher taxable profits, and it will become the basis for deferred tax assets.

The third reason for deferred tax assets, which will result in lower taxes in the future, is carried forwarded losses. Carried forward losses will be adjusted against the future taxable profits which will result in lower taxable profits and ultimately, it will lead to lower tax liability. The period over which losses can be carried forward vary from jurisdiction to jurisdiction, and we need to wait for the law for the exact period for which these losses can be carried forwarded.

International Financial Reporting Standards [‘IFRS’) states that deductible temporary differences are: “temporary differences that will result in amounts that are deductible in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled”.

Keeping in view the above definition of IFRS, in the aforesaid examples, rent of Dh80,000 and warranty of Dh3,000 are deductible temporary differences. The registered business will pay more tax in the current period due to these two factors. These amounts will be deductible in the future to ascertain the relevant period’s taxable profits.

IFRS with the few exceptions further states that: “a deferred tax asset shall be recognised for all deductible temporary differences to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised”.

Since deductible temporary differences are Dh83,000 [80,000+3,000], so the registered business will book deferred tax asset of Dh7,470 [83,000*9% (applicable corporate tax rate)] by assuming that future taxable profits would be available against which the deductible temporary difference will be utilised.

The period in which deductible temporary differences are greater than taxable temporary differences, in that period tax expense would be lower than the tax liability, and the differential will be booked as deferred tax asset in the statement of financial position. The period in which taxable temporary differences are higher than deductible temporary differences, in that period tax expense would be higher than tax liability and the differential will be booked as deferred tax liability which we will cover in our next article.

The above understanding is based on the global practices and requirements of IFRS 12. Once the UAE government introduces corporate law, it will set a clear basis for corporate tax computation.

Source:https://www.khaleejtimes.com/finance/what-are-deferred-tax-assets