UAE reaffirms commitment to strengthen anti-money laundering regulations to combat financial crimes

Effective measures implemented to protect financial environment

The UAE has reaffirmed its ongoing commitment and efforts to strengthen its regulatory framework in relation to anti-money laundering (AML) and counter terrorist financing (CFT).

The authorities are continuing to maintain and implement effective sanctions with robust screening systems and processes, to ensure the integrity, safety and security of the global financial system.

Hamid Al Zaabi, Director General of the UAE Executive Office for Anti-Money Laundering and Counter Terrorist Financing, said, “As a global commercial hub, the UAE is open to businesses and entrepreneurs from all over the world. At the Executive Office for AML/CFT, our objective is to continuously strengthen the UAE’s framework for combatting financial crime.”

To date, effective measures and proactive regulatory action for protecting the nation’s financial environment have been implemented by the authorities, including the Central Bank of the UAE; Securities and Commodities Authority; Ministry of Economy; Ministry of Justice; Abu Dhabi Global Market; and the Dubai Financial Services Authority, as well as close inter-agency cooperation.

On the regulatory front, Al Zaabi said, “We are actively advancing our approach, offering a stable and effective system of regulation and enforcement in line with international standards. We are working with the business community to ensure they can comply and thrive in an attractive and resilient environment.”

Talal Mohammed Al Teneiji, Director of the Executive Office for Control and Non-Proliferation said, “As a responsible member of the international community, the UAE is committed to securing the stability and integrity of the country’s economy through the application of targeted financial sanctions.”

Source:https://www.khaleejtimes.com/finance/%e2%80%8fuae-reaffirms-commitment-to-strengthen-anti-money-laundering-regulations-to-combat-financial-crimes

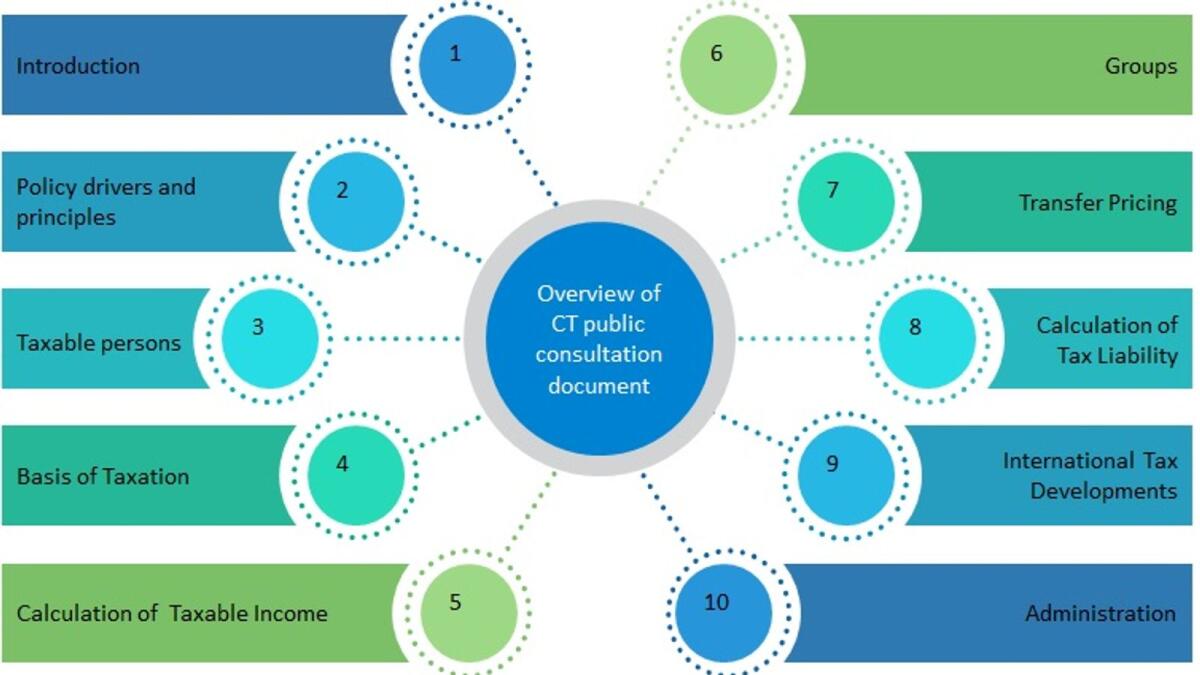

Overview of the corporate tax public consultation document

The consultation document is containing 10 sections starting from the introduction and ending with the administration

On January 31, 2022, the Ministry of Finance (MoF) announced that the UAE will introduce the corporate tax on the taxable profits of the businesses effective from the financial year starting on or after June 01, 2023. In continuation of the finalisation of the UAE corporate tax (CT) regime, on April 28, 2022, the MoF issued the public consultation document to seek the opinion of the stakeholders on the main features and smooth implementation of the corporate tax which would be helpful for the MoF to receive input from the interested parties and make informed decisions.

The consultation document is containing 10 sections starting from the introduction and ending with the administration. In the first and second sections of the consultation document, MoF has highlighted the purpose of issuing the consultation document and the rationale behind the issuance of CT regime in the UAE respectively.

• have Permanent establishment in the UAE (UAE source income will be subject to CT)

• earn any UAE source income (UAE source income will be subject to CT)

The tax on unincorporated partnerships, joint ventures and associations of persons depends upon their presence and liability of their partners.

The fourth section covers the definition of residents and non-residents. The legal persons incorporated in the UAE will automatically be considered residents. The foreign companies will be UAE residents if effectively managed and controlled in the UAE. The natural person who is engaged in business or commercial activity in the UAE will be a UAE resident. Anyone who is not a resident will be considered a non-resident. The residents are taxable in the UAE on their worldwide income and non-residents will be subject to tax in UAE on taxable income of their PE in the UAE and UAE sourced income.

The fifth section contains the approach to calculate the taxable income which states that financial statements profits calculated as per IFRS will be adjusted to arrive at the taxable income.

In the sixth section, it has been given that the UAE resident group of companies can form a tax group and be treated as a single taxable person. Moreover, it covers the conditions to enter into the tax group. The rules related to the transfer of losses, group relief and restructuring relief has been given in detail.

The seventh section highlights that there would be transfer pricing rules and transactions between the related parties would be on an arms-length basis. Arm length principles and documents requirement has been given in this section as well.

In the eighth section, it has been given that the zero per cent tax would be applicable on the taxable income up to Dh375,000, and any taxable income beyond Dh375,000 would be subject to tax at the rate of nine per cent. The zero per cent withholding tax would apply to the following domestic and cross border payments made by the UAE businesses:

• UAE sourced income earned by a foreign company that is not attributable to a PE in the UAE of that foreign company.

• Mainland UAE sourced income earned by a Free Zone Person that benefits from the zero per cent CT regime

• Dividends and other profit distributions made by a Free Zone Person that benefits from the zero per cent

TThe UAE and over 130 other countries reached an agreement on BEPS 2.0. The ninth section will cover the proposed approach by the UAE to respond to BEPS 2.0, and set the basis for the reallocation of profits from where sales arises and the requirement for the global minimum tax of fifteen per cent

A business subject to CT will need to register with the FTA and obtain a tax registration number. Every registered business will be required to file an annual tax return and make payment within nine months from the end of the relevant financial year, and it has been given in the last section of the public consultation document.

Source:https://www.khaleejtimes.com/finance/overview-of-the-corporate-tax-public-consultation-document?_refresh=true

Transforming finance: NAFA 2022 to highlight business resilience in uncertain times

Taking place on May 17 in Dubai, the third edition of the event will take a deep dive into how organisations can prepare for any future uncertainty, where growth opportunities lie, and how CFOs can play a critical role in influencing business resilience and change

As economies across the Middle East look towards overcoming the challenges brought about by the Covid-19 pandemic over the past two years, finance and accounting leaders say that there has never been a better time for the region’s finance and accounting community to come together and learn how to survive and thrive.

Towards this mission, Khaleej Times has organised the third edition of the New Age Finance and Accounting Summit (NAFA 2022) which brings together several industry-leading experts to debate and discuss on strategies that designed to promote responsible financial trends. Taking place on May 17 in Dubai, the third edition of the event will take a deep dive into how organisations can prepare for any future uncertainty, where growth opportunities lie, and how CFOs can play a critical role in influencing business resilience and change.

The event is presented with the support of Vuram as the event’s Hyper Automation Partner; Gold Sponsors Jedox and Qashio; Silver Sponsor Crowe; Associate Sponsor Zoho; and Automation Anywhere as the events RPA Partner.

The cross industry forum is designed as an in-person format that will bring together finance leaders and professionals from across the GCC countries to discuss on the existing professional landscape, deliberate on the role of technology within their domain, and develop strategies for upcoming opportunities and challenges. With deep rooted research and observations of the industry, the summit will focus on finance transformation through advanced technologies, cultural transformation after the pandemic, the impact of AI, Machine Learning, RPA, Predictive Analytics, Blockchain, Cloud infrastructure and more.

The event features an in-person conference that presents an unprecedented opportunity for the finance and accounting experts of the region to gear up for the future with technology and innovation. Attendees will also gain insights on areas like financial planning, risk management, digital innovation, and emerging technologies. They will also be a part of interactive masterclasses focusing on specific upcoming technologies and offering practical solutions to challenges and issues faced by the modern finance and accounting professional.

Lastly, the event will also feature the NAFA CFO POWERLIST which will shine a spotlight on and celebrate exemplary achievements of finance leadership, innovation, and raised benchmarks by top CFOs from the field of accounting and finance in the Middle East.

Source:https://www.khaleejtimes.com/finance/transforming-finance-nafa-2022-to-highlight-business-resilience-in-uncertain-times

NAFA 2022: Prepare for the next gen of finance leaders

The role of finance, and in particular that of the CFO, has rapidly evolved in the era of unprecedented levels of change and uncertainty

Business leaders in the finance and accounting industry need to dedicate their time to ensuring that they are preparing the next generation of finance professionals.

Speaking at the New Age Finance and Accounting Summit 2022, Adnan Patel, Principal Consulting, Crowe, stressed that knowledge is key, especially in an industry that has seen countless disruptions. Towards this end, he noted that there has been an increasing focus on acquiring the right type of talent across the finance industry.

“We have to change the people that we are recruiting,” he said. “We have to go to the financial institutions that we graduated from and challenge them to better educate and better prepare the next generation of financial leaders. Only then can we start expecting people to execute our strategies. Execution is key, but so is having proper systems in place. The question is where do you want to go, and the answer is that we want to go where there is opportunity.”

Similarly, Andreas Simon, regional director MEA at Jedox, shared how important it is to have not only the right technology in place, but also the proper processes to improve business efficiency and drive digital transformation. Citing Gartner, he noted that 70 per cent of new financial planning and analysis will become extended planning and analysis, or xP&A, projects by 2024.

“The role of finance, and in particular that of the CFO, has rapidly evolved in the era of unprecedented levels of change and uncertainty,” he said. “Finance teams need to provide the business with insight and direction for informed decision-making. Now is the time for CFOs to leverage the latest technologies and transform the finance function to the critical role of business partner, champion of change, and profit driver within their organisations.”

Technology plays key role

Gururajan Krishnamurthy, head accountant channel Middle East, ZOHO, said that there are several technologies that have resulted in major disruptions in the finance industry. Chief among them, he said, has been the monumental shift towards the Cloud. A new business model has to be adapted to the needs of the hour, he advised.

“From an operational perspective, there are three key areas where you need to direct your focus,” he said. “These include cost, control, and compliance. Cloud based solutions represent a potential cost savings of 30 per cent over their on-premise equivalents. Cloud lets you add new business jurisdiction and auto update local rules, minimizing the maintenance cost.”

Narendran Thillaisthanam, chief technology officer at Vuram, also highlighted Hyperautomation as a new trend in the industry. Hyperautomation, he explained, is a business-driven and disciplined approach that organisations use to rapidly identify, vet, and automate as many business and IT processes as possible. According to Gartner, by 2024, more than 70 per cent of large enterprises will have over 70 concurrent Hyperautomation initiatives.

“Hyperautomation is the solution to many disruptions in the industry,” he said. “Five per cent of occupations today consist of activities that are 100 per cent automatable. In addition, about 60 per cent of occupations have at least 30 per cent of their activities that are automatable.”

Dinesh Chandra, regional vice president of Automation Anywhere, also shared his insights on workforce transformation and the technologies that will be critical for it. “Our world is changing faster than ever, and companies are facing a workforce transformation. They are racing to transform into a digital workforce with automation and AI.”

According to research by Gartner, over 80 per cent of organisations are investing more in automation. Towards this end, businesses are increasingly looking towards digital workers – software bots designed to execute activities, tasks, and operations across digital systems 24/7. These digital workers will help people and teams create value and accelerate the pace of work. They will also leave employees with more time to solve problems, build relationships, and innovate.

“So, why do companies use a digital workforce in finance? There are several reasons: You can streamline manual processes to increase cash flow and reduce costs; accelerate the financial close to provide timely information for sound business decision making; tighten controls to improve accuracy and compliance with regulatory requirements; expand digital and cognitive intelligence capabilities; and make the human workforce more productive and focused on value-added activities.”

Source:https://www.khaleejtimes.com/business/nafa-2022-prepare-for-the-next-gen-of-finance-leaders