UAE corporate tax: Registration, deadlines explained

If a person has a licence issued in January or February (irrespective of the year), he has to submit a tax registration application by May 31, 2024

The Federal Tax Authority has reitreated deadlines for the registration of taxable persons for corporate tax.

The announcement on X, as part of FTA’s awareness campaign to help taxpayers meet their tax obligations under the Corporate Tax law, are for resident juridical persons that were incorporated or otherwise established or recognised prior to March 1 2024.

The tax are based on the date their licence was issued.

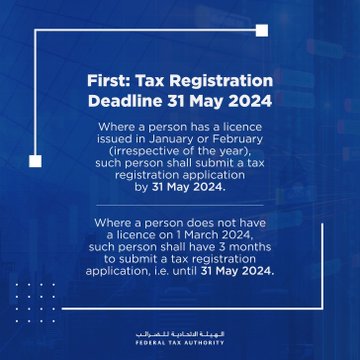

According to the tax authority, if a person has a licence issued in January or February (irrespective of the year), such person shall submit a tax registration application by May 31, 2024.

In case a person does not have a licence on March 1, 2024, such a person shall have three months to submit a tax registration application until May 31, 2024.

The FTA also posted month-wise tax registration deadlines.