Dubai emerges popular destination for entrepreneurs, millionaires and startups

Recent visa reforms, change in weekend in line with international markets and conducive environment for business will attract high net worth individuals (HNIs) and worldwide investors in key sectors of the economy

Dubai is an established international business hub and recent visa and labour reforms will further strengthen its position as a popular destination for entrepreneurs, millionaires, startups and scale-up businesses, experts say.

Analysts, executives and industry specialists said recent visa reforms, change in weekend in line with international markets and conducive environment for business will attract high net worth individuals (HNIs) and worldwide investors in key sectors of the economy.

Referring to the new rules for the 10-year Golden Visa, five-year Green Visa and other reforms, experts said Dubai will attract global talent, skilled professionals, freelancers, investors, and entrepreneurs that will ultimately benefit the economy

Saad Maniar, senior partner at Crowe, said Dubai has always been and will continue to be the popular destination for HNIs from tourism perspective, as Dubai has very high standards of safety and security coupled with the amazing infrastructure and plenty of to-do things in Dubai.

“From the business perspective the overall infrastructure is business friendly, with airlines offering connectivity to all major cities in the world, makes it very attractive for business owners to establish their presence in Dubai,” Maniar told Khaleej Times on Sunday.

“Over the years, we have seen that a small percentage of tourist are attracted toward Dubai, so much so that they end of getting employment or start their own business, which is not normally the case for other places in the world,” he said.

Tourism a major beneficiary

Fadi Rizkallah, general manager, Freedom2Work.com , echoed the similar views and said recent reforms will have positive impact on Dubai economy in general and tourism sector in particular.

“I believe that visa reforms will in turn have an encouraging effect on personnel from all high end backgrounds. The better facilitation for individuals to find and explore the economic benefits of a country, the more inclined they are to take risks and jump on the business wagon of establishing the next successful enterprise,” he said.

“Better visa reforms are a social security indicator which provides a safe investing haven for people with the right financial mentality, opening up a place and attracting the young and innovative mind to come,” he said.

Dubai a safe destination

Pratik Rawal, managing partner, Ascent Partners, said Dubai is an established international commercial hub and it is one of the safest destinations for high net worth individual and entrepreneurs.

“All of that and more. The banks appear optimistic with the new visa reforms, which reveal Dubai to be a stable and safe place to conduct business and scale-up for a long-term investment,” Pratik told Khaleej Times on Sunday.

Ms Sakina Dickenwala, associate partner – Legal at MBG Corporate Services, said a major purpose for the new visa reforms was to make the country more attractive investors, entrepreneurs, and HNIs.

“For one, holders of golden visas are no longer restricted by the amount of the time they can spend outside the country. This allows HNIs with international commitments the freedom of movement that they require. It will also be possible for those looking to create startups to apply for a green visa. Much like the golden visa, a green visa will not require a sponsor. This visa will allow entrepreneurs the ability to move to Dubai with the exclusive purpose of establishing a business, without having to be concerned with the hassle of finding a sponsor,” Dickenwala said.

Investors paradise

Hatem Elsafty, managing director, Business Link, said Dubai has long been home to various tourists and businesses in different industries – which to date, are flourishing increasingly.“This makes Dubai a massive business hub that continues to bring in local and foreign investors. With some of the best incentives offered and a highly flexible business environment, it’s one of the top locations for businesses of any size,” he said.

He said the reasons for the same are quite straightforward. Firstly, given the large scale at which businesses in the city operate, Dubai offers the opportunity to house your business in an economic zone best fit for your needs. Known as mainland, freezone, and offshore, these zones have their own laws and cater to your unique business requirements and needs, he said.

Secondly, he said the federal corporate tax imposed by UAE is among the lowest in the world. “Placed at nine per cent on profits up to Dh375,000, the tax regime is set to be effective after June 1, 2023. To run operations in an economy as vibrant as the one UAE has with minimal tax is nothing less of a dream for investors,” he said.

Lastly, he said with the UAE government looking to grow its economy, it is home to a plethora of startup incubators and funding initiatives.

“Partnering with investors looking to grow and start their brand not only helps the country and its economy but also provided necessary aid to investors looking for support,” Elsafty concluded.

Application of corporate tax on the individuals and legal persons

If the individual is conducting any commercial activity which requires a licence from the related authorities, the individual would be required to take the permit, and the UAE source income of the individual would be subject to corporate tax

The persons subject to corporate tax (CT), can be classified into natural persons and legal persons. The natural persons who fulfil the criteria would fall under the scope of CT, and in the same way, the legal persons that satisfy the specific conditions would be subject to CT. On the other hand, natural and legal persons who do not meet the criteria would be exempt from CT. In this article, we have covered the proposed treatment of CT on natural persons and legal persons.

Application of CT on the natural person:

The individuals can conduct some activities in the UAE without taking a commercial licence/permit, and such income of individuals would not be subject to CT. For example, individuals’ employment income, dividend income, rental income from the investment in the property and other investment income.

If the investments in the real estate and other areas are held through a private or family trust on behalf of individual beneficiaries, the trust would be subject to the same CT treatment like for a natural person. If the individual family members own the property/properties, they can create trust and shift all their properties under the trust. The trust would be managing all such properties on behalf of the individuals who would be beneficiaries of the income. Such income of the trust will not be subject to CT.

Application of CT on the legal person:

The legal persons can be classified into incorporated persons like limited liability companies (LLC), public joint-stock companies (PJSC), private shareholding companies etc. and unincorporated persons like partnerships, joint ventures (JVs) and associations of persons (AoP). The incorporated persons may be incorporated in the UAE or out of the UAE. If the legal persons are incorporated in the UAE, their worldwide income will be subject to CT, and if the businesses are incorporated out of the UAE, still their income would be subject to CT in the UAE if these businesses:

• are being controlled and managed in the UAE (worldwide income will be subject to CT).

• have Permanent establishment in the UAE (UAE source income will be subject to CT)

• earn any UAE source income (UAE source income will be subject to CT)

Like incorporated persons, unincorporated persons like partnerships, JVs, and AoP may be in the UAE or out of the UAE. If these are in the UAE, businesses would be required to assess whether their partners have limited or unlimited liability. If any of the partners have unlimited liability, these entities are called “transparent” and their income would be subject to CT in the hands of the partners or members. This means that these entities will not be subject to CT but their net taxable income will be subject to CT in the hands of the partners or members. On the other hand, where the liability of all partners is limited, such partnerships will be treated like an incorporated company in the UAE.

If the partners or members are living in the UAE, and unincorporated persons are located out of the UAE, then some countries may treat them as “transparent” entities and others may treat them as a company. Such non-resident unincorporated persons will have the same CT treatment in the UAE like these will have in their respective countries.

The businesses and natural persons are required to assess their status and be prepared for the CT accordingly.

Source:https://www.khaleejtimes.com/finance/application-of-corporate-tax-on-the-individuals-and-legal-persons

UAE reaffirms commitment to strengthen anti-money laundering regulations to combat financial crimes

Effective measures implemented to protect financial environment

The UAE has reaffirmed its ongoing commitment and efforts to strengthen its regulatory framework in relation to anti-money laundering (AML) and counter terrorist financing (CFT).

The authorities are continuing to maintain and implement effective sanctions with robust screening systems and processes, to ensure the integrity, safety and security of the global financial system.

Hamid Al Zaabi, Director General of the UAE Executive Office for Anti-Money Laundering and Counter Terrorist Financing, said, “As a global commercial hub, the UAE is open to businesses and entrepreneurs from all over the world. At the Executive Office for AML/CFT, our objective is to continuously strengthen the UAE’s framework for combatting financial crime.”

To date, effective measures and proactive regulatory action for protecting the nation’s financial environment have been implemented by the authorities, including the Central Bank of the UAE; Securities and Commodities Authority; Ministry of Economy; Ministry of Justice; Abu Dhabi Global Market; and the Dubai Financial Services Authority, as well as close inter-agency cooperation.

On the regulatory front, Al Zaabi said, “We are actively advancing our approach, offering a stable and effective system of regulation and enforcement in line with international standards. We are working with the business community to ensure they can comply and thrive in an attractive and resilient environment.”

Talal Mohammed Al Teneiji, Director of the Executive Office for Control and Non-Proliferation said, “As a responsible member of the international community, the UAE is committed to securing the stability and integrity of the country’s economy through the application of targeted financial sanctions.”

Source:https://www.khaleejtimes.com/finance/%e2%80%8fuae-reaffirms-commitment-to-strengthen-anti-money-laundering-regulations-to-combat-financial-crimes

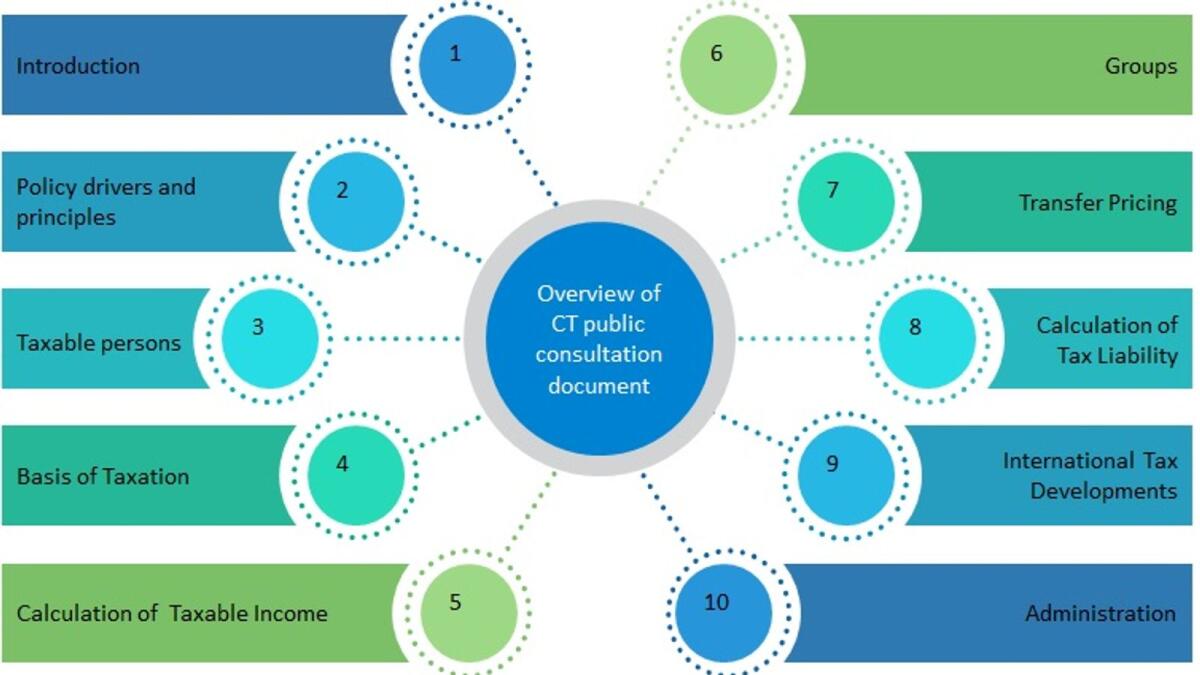

Overview of the corporate tax public consultation document

The consultation document is containing 10 sections starting from the introduction and ending with the administration

On January 31, 2022, the Ministry of Finance (MoF) announced that the UAE will introduce the corporate tax on the taxable profits of the businesses effective from the financial year starting on or after June 01, 2023. In continuation of the finalisation of the UAE corporate tax (CT) regime, on April 28, 2022, the MoF issued the public consultation document to seek the opinion of the stakeholders on the main features and smooth implementation of the corporate tax which would be helpful for the MoF to receive input from the interested parties and make informed decisions.

The consultation document is containing 10 sections starting from the introduction and ending with the administration. In the first and second sections of the consultation document, MoF has highlighted the purpose of issuing the consultation document and the rationale behind the issuance of CT regime in the UAE respectively.

• have Permanent establishment in the UAE (UAE source income will be subject to CT)

• earn any UAE source income (UAE source income will be subject to CT)

The tax on unincorporated partnerships, joint ventures and associations of persons depends upon their presence and liability of their partners.

The fourth section covers the definition of residents and non-residents. The legal persons incorporated in the UAE will automatically be considered residents. The foreign companies will be UAE residents if effectively managed and controlled in the UAE. The natural person who is engaged in business or commercial activity in the UAE will be a UAE resident. Anyone who is not a resident will be considered a non-resident. The residents are taxable in the UAE on their worldwide income and non-residents will be subject to tax in UAE on taxable income of their PE in the UAE and UAE sourced income.

The fifth section contains the approach to calculate the taxable income which states that financial statements profits calculated as per IFRS will be adjusted to arrive at the taxable income.

In the sixth section, it has been given that the UAE resident group of companies can form a tax group and be treated as a single taxable person. Moreover, it covers the conditions to enter into the tax group. The rules related to the transfer of losses, group relief and restructuring relief has been given in detail.

The seventh section highlights that there would be transfer pricing rules and transactions between the related parties would be on an arms-length basis. Arm length principles and documents requirement has been given in this section as well.

In the eighth section, it has been given that the zero per cent tax would be applicable on the taxable income up to Dh375,000, and any taxable income beyond Dh375,000 would be subject to tax at the rate of nine per cent. The zero per cent withholding tax would apply to the following domestic and cross border payments made by the UAE businesses:

• UAE sourced income earned by a foreign company that is not attributable to a PE in the UAE of that foreign company.

• Mainland UAE sourced income earned by a Free Zone Person that benefits from the zero per cent CT regime

• Dividends and other profit distributions made by a Free Zone Person that benefits from the zero per cent

TThe UAE and over 130 other countries reached an agreement on BEPS 2.0. The ninth section will cover the proposed approach by the UAE to respond to BEPS 2.0, and set the basis for the reallocation of profits from where sales arises and the requirement for the global minimum tax of fifteen per cent

A business subject to CT will need to register with the FTA and obtain a tax registration number. Every registered business will be required to file an annual tax return and make payment within nine months from the end of the relevant financial year, and it has been given in the last section of the public consultation document.

Source:https://www.khaleejtimes.com/finance/overview-of-the-corporate-tax-public-consultation-document?_refresh=true