Transforming finance: NAFA 2022 to highlight business resilience in uncertain times

Taking place on May 17 in Dubai, the third edition of the event will take a deep dive into how organisations can prepare for any future uncertainty, where growth opportunities lie, and how CFOs can play a critical role in influencing business resilience and change

As economies across the Middle East look towards overcoming the challenges brought about by the Covid-19 pandemic over the past two years, finance and accounting leaders say that there has never been a better time for the region’s finance and accounting community to come together and learn how to survive and thrive.

Towards this mission, Khaleej Times has organised the third edition of the New Age Finance and Accounting Summit (NAFA 2022) which brings together several industry-leading experts to debate and discuss on strategies that designed to promote responsible financial trends. Taking place on May 17 in Dubai, the third edition of the event will take a deep dive into how organisations can prepare for any future uncertainty, where growth opportunities lie, and how CFOs can play a critical role in influencing business resilience and change.

The event is presented with the support of Vuram as the event’s Hyper Automation Partner; Gold Sponsors Jedox and Qashio; Silver Sponsor Crowe; Associate Sponsor Zoho; and Automation Anywhere as the events RPA Partner.

The cross industry forum is designed as an in-person format that will bring together finance leaders and professionals from across the GCC countries to discuss on the existing professional landscape, deliberate on the role of technology within their domain, and develop strategies for upcoming opportunities and challenges. With deep rooted research and observations of the industry, the summit will focus on finance transformation through advanced technologies, cultural transformation after the pandemic, the impact of AI, Machine Learning, RPA, Predictive Analytics, Blockchain, Cloud infrastructure and more.

The event features an in-person conference that presents an unprecedented opportunity for the finance and accounting experts of the region to gear up for the future with technology and innovation. Attendees will also gain insights on areas like financial planning, risk management, digital innovation, and emerging technologies. They will also be a part of interactive masterclasses focusing on specific upcoming technologies and offering practical solutions to challenges and issues faced by the modern finance and accounting professional.

Lastly, the event will also feature the NAFA CFO POWERLIST which will shine a spotlight on and celebrate exemplary achievements of finance leadership, innovation, and raised benchmarks by top CFOs from the field of accounting and finance in the Middle East.

Source:https://www.khaleejtimes.com/finance/transforming-finance-nafa-2022-to-highlight-business-resilience-in-uncertain-times

NAFA 2022: Prepare for the next gen of finance leaders

The role of finance, and in particular that of the CFO, has rapidly evolved in the era of unprecedented levels of change and uncertainty

Business leaders in the finance and accounting industry need to dedicate their time to ensuring that they are preparing the next generation of finance professionals.

Speaking at the New Age Finance and Accounting Summit 2022, Adnan Patel, Principal Consulting, Crowe, stressed that knowledge is key, especially in an industry that has seen countless disruptions. Towards this end, he noted that there has been an increasing focus on acquiring the right type of talent across the finance industry.

“We have to change the people that we are recruiting,” he said. “We have to go to the financial institutions that we graduated from and challenge them to better educate and better prepare the next generation of financial leaders. Only then can we start expecting people to execute our strategies. Execution is key, but so is having proper systems in place. The question is where do you want to go, and the answer is that we want to go where there is opportunity.”

Similarly, Andreas Simon, regional director MEA at Jedox, shared how important it is to have not only the right technology in place, but also the proper processes to improve business efficiency and drive digital transformation. Citing Gartner, he noted that 70 per cent of new financial planning and analysis will become extended planning and analysis, or xP&A, projects by 2024.

“The role of finance, and in particular that of the CFO, has rapidly evolved in the era of unprecedented levels of change and uncertainty,” he said. “Finance teams need to provide the business with insight and direction for informed decision-making. Now is the time for CFOs to leverage the latest technologies and transform the finance function to the critical role of business partner, champion of change, and profit driver within their organisations.”

Technology plays key role

Gururajan Krishnamurthy, head accountant channel Middle East, ZOHO, said that there are several technologies that have resulted in major disruptions in the finance industry. Chief among them, he said, has been the monumental shift towards the Cloud. A new business model has to be adapted to the needs of the hour, he advised.

“From an operational perspective, there are three key areas where you need to direct your focus,” he said. “These include cost, control, and compliance. Cloud based solutions represent a potential cost savings of 30 per cent over their on-premise equivalents. Cloud lets you add new business jurisdiction and auto update local rules, minimizing the maintenance cost.”

Narendran Thillaisthanam, chief technology officer at Vuram, also highlighted Hyperautomation as a new trend in the industry. Hyperautomation, he explained, is a business-driven and disciplined approach that organisations use to rapidly identify, vet, and automate as many business and IT processes as possible. According to Gartner, by 2024, more than 70 per cent of large enterprises will have over 70 concurrent Hyperautomation initiatives.

“Hyperautomation is the solution to many disruptions in the industry,” he said. “Five per cent of occupations today consist of activities that are 100 per cent automatable. In addition, about 60 per cent of occupations have at least 30 per cent of their activities that are automatable.”

Dinesh Chandra, regional vice president of Automation Anywhere, also shared his insights on workforce transformation and the technologies that will be critical for it. “Our world is changing faster than ever, and companies are facing a workforce transformation. They are racing to transform into a digital workforce with automation and AI.”

According to research by Gartner, over 80 per cent of organisations are investing more in automation. Towards this end, businesses are increasingly looking towards digital workers – software bots designed to execute activities, tasks, and operations across digital systems 24/7. These digital workers will help people and teams create value and accelerate the pace of work. They will also leave employees with more time to solve problems, build relationships, and innovate.

“So, why do companies use a digital workforce in finance? There are several reasons: You can streamline manual processes to increase cash flow and reduce costs; accelerate the financial close to provide timely information for sound business decision making; tighten controls to improve accuracy and compliance with regulatory requirements; expand digital and cognitive intelligence capabilities; and make the human workforce more productive and focused on value-added activities.”

Source:https://www.khaleejtimes.com/business/nafa-2022-prepare-for-the-next-gen-of-finance-leaders

Compliance of economic substance regulations is a must to avoid penalties

Non-compliance with the ESR is subject to penalties ranging from Dh20,000 to D400,000. To avoid this, it is recommended that the licensee must comply with the ESR.

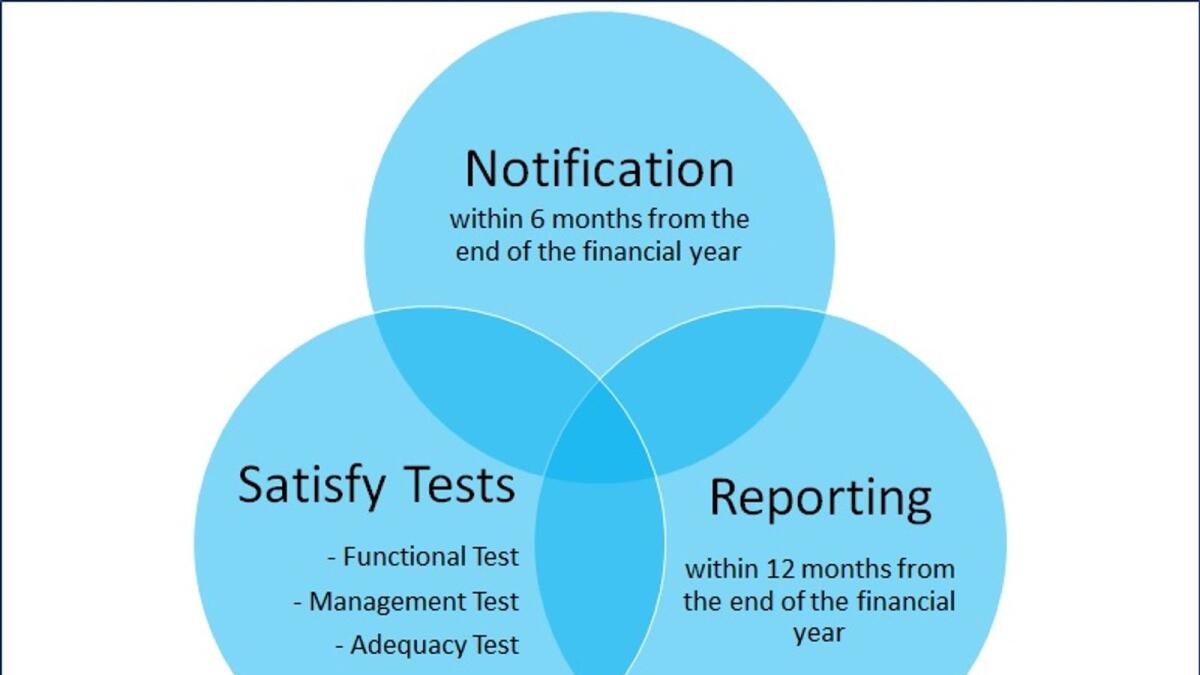

As discussed in our previous article, every licensee who earns relevant income from a relevant activity should submit notification within six months from the end of the relevant financial year, satisfy the economic substance test and submit the report within twelve months from the end of the relevant financial year.

The term licensee, with certain exceptions, means a juridical person (a legal entity — incorporated inside or outside the state); or an unincorporated partnership registered in the state, including a free zone and financial free zone, and conducts relevant activity.

The term relevant income means all gross income from a relevant activity recorded in the books of the licensee, and the word relevant activity means any of the nine specific activities mentioned in our previous article which we will discuss in detail in the future.

ESR notification

The notification is required to be submitted within six months from the end of the relevant financial year. The notification requires some basic information like licensee name, commercial license number, regulatory authority, legal status, information about the relevant activity, ownership and ultimate ownership, parent company and ultimate parent company etc. of the licensee. The notification requires to be submitted online on the Ministry of Finance (MoF) portal. As far as information about the relevant activity is concerned, the license is required to acknowledge relevant activity/activities executed by the licensee, and acceptance about the relevant income earned during the reportable period. The reporting of the financial numbers is not required in the notification but acknowledgement/acceptance of the relevant activity and relevant income.

ESR testing

The licensee is required to comply with the (i) functional test, (ii) management test and (iii) adequacy test. The licensee who earns relevant income from the relevant activity is compulsorily required to comply with these tests.

The functional test requires that the licensee conducts Core Income-Generating Activity/Activities (CIGA) in the State. If the CIGA is being conducted out of the United Arab Emirates (UAE), the licensee would be considered non-compliant, and it would attract penalties accordingly. Compliance with this test is not required in the case of holding company relevant activity. This means, that the CIGA related to the purely holding company business can be conducted out of the UAE, and it would not be considered non-compliance.

The management test demands that the licensee is being directed and managed in the UAE. The direction and management require that there should be adequate (at least one) board meeting in the UAE in a year. In the board meeting, there should be a full quorum and directors should be physically present. If the licensee is managed by its shareholders/owners/partners, then these requirements will be fully applicable possible to the manager/managers.

Moreover, the law demands that minutes of the meeting should be taken and should be in writing. The minutes should be signed by all directors attending the meetings. The minutes record the making of strategic decisions taken in the meeting. Minutes of all board meetings and related records should be kept in the UAE. The ESR law requires that the directors of the licensee have the necessary knowledge and expertise to discharge their duties.

Under the adequacy test, the licensee must have (i) adequate employees, (ii) adequate operating expenditures, and (iii) adequate physical assets. The law requires that the licensee or the third party to whom work has been outsourced must have an adequate number of qualified full-time employees who are physically present in the UAE. The employee can be employed by the licensee or third party, temporary contract, or long-term contract.

Moreover, the law requires that the licensee or third party to whom work has been outsourced must have adequate operating expenditure in the state. To comply with the law the licensee or third party must have adequate physical assets in the state. The physical assets include offices or business premises, and such premises may be owned or leased by the licensee.

ESR report

As mentioned above, the licensee is required to submit the report within 12 months from the end of the relevant financial year. The report is required to be submitted on the MoF portal. In the report, along with the basic information, the licensee is required to provide the financial information like the amount of revenue earned from the relevant activity/activities, number of employees, number of meetings etc. that we will discuss in detail in our next articles.

Non-compliance with the ESR is subject to penalties ranging from Dh20,000 to D400,000. To avoid this, it is recommended that the licensee must comply with the ESR.

Source:https://www.khaleejtimes.com/finance/compliance-of-economic-substance-regulations-is-a-must-to-avoid-penalties

Scope of Economic Substance Regulations

If the entities are carrying business only in the UAE, or entities whose income is being taxed in other countries are not subject to ESR in the UAE. ESR is not applicable to natural persons, sole proprietorships, trusts and foundations

In our previous article, we discussed the reasons for implementing Economic Substance Regulations (ESR), which were to counter harmful tax practices and curb tax evasion.

We highlighted that the UAE, being a member of the Organisation of Economic Cooperation and Development (OECD) inclusive framework, introduced ESR law (the Law) under the Cabinet Decision No.31 of 2019, which was replaced by Cabinet Decision No. 57 of 2020. The UAE issued Guidance no. 215 of 2019, which was replaced by MD 100 of 2020 for the smooth implementation of ESR in the UAE.

The law requires that every licensee who earns relevant income from a relevant activity must comply with the followings:

• submit notification within six months from the end of the relevant financial year

• satisfy economic substance test

• submit the report within twelve months from the end of the relevant financial year

The term licensee used above means a juridical person (a legal entity — incorporated inside or outside the state); or an unincorporated partnership registered in the state, including a free zone and financial free zone, and carries out relevant activity.

In the light of the above, any legal entity and unincorporated partnership that meets the above-mentioned criteria can be classified as a licensee, but there are following exceptions to the above definition, and the excepted entities are not required to comply with ESR law and related regulations.

• A licensee that is an investment fund

• A licensee that is a tax resident in a jurisdiction other than a state

• A licensee that is:

o Owned by resident or residents (directly or indirectly) in the state

o It’s not part of the MNE Group (a group that has entities in different jurisdictions or an entity that is tax resident in one jurisdiction and subject to tax in another jurisdiction due to its activities carried through permanent establishment or branch).

o It only carries out business in the state.

• A licensee that is a branch of a foreign entity the relevant income of which is subject to tax in a jurisdiction other than the state; and

• Any other licensee as determined pursuant to the decision of the Minister of Finance

• Sole proprietorships, trusts and foundations

From the above exceptions, it is evident that if the entities are carrying business only in the UAE, or entities whose income is being taxed in other countries are not subject to ESR in the UAE. ESR is not applicable to natural persons, sole proprietorships, trusts and foundations.

The juridical persons and unincorporated partnerships if not earning any relevant income, are not subject to ESR. The entities owned by the government will also be tested based on the above criteria and have not any notable exceptions.

The juridical persons and unincorporated partnerships which are conducting relevant activities and earning relevant income as well can further be classified into exempted entities and non-exempted entities. The exempted entities will have to submit a notification and they will have to prove the reasons for not being subject to ESR. In case of non-compliance, these would be treated as normal licensees. The non-exempted entities will have to submit the ESR notification within six months from the end of the relevant financial years, and if they are earning relevant income, they will have to comply with the ESR test and submit the related report as well within twelve months from the end of the relevant financial years.

The term relevant income means all gross income from a relevant activity that is recorded in the books and records of the licensee or the exempted Licensee under the accounting standards, whether earned in the UAE or outside the UAE and irrespective of whether the entity has derived a profit or loss from its activities. In the context of income from sales or services, gross income means gross revenues from sales or services without deducting the cost of goods sold or the cost of services.

The word relevant activity means any of these nine activities. Like the activity of (i) banking business, (ii) insurance business, (iii) investment fund management business, (iv) lease finance business, (v) headquarters business, (vi) shipping business, (vii) holding company business, (viii) intellectual property business and (ix) distribution and service sector business.

It is recommended to assess your business based on the above criteria to ascertain whether your entity is subject to ESR or not. The entities that are not conducting relevant activities, but their trade license is carrying the relevant activities, it is highly recommended that such entities should submit notification within the due date to avoid penalties.

Source:https://www.khaleejtimes.com/finance/scope-of-economic-substance-regulations