UAE: New tax exemption rules issued for companies in free zones

Experts say grey areas like availability of 0% corporate tax benefit on high sea sales, investment in cryptocurrencies addressed in new FTA guide

Companies doing businesses in free zones in the UAE need to meet certain criteria to be eligible for zero per cent corporate income tax on their activities and become a qualifying free zone person (QFZP), according to the latest guide issued by the Federal Tax Authority (FTA).

Among the conditions include “possession of audited financial statements, having substance, and earning income from qualifying activities”, said Thomas Vanhee, partner at Aurifer Middle East Tax Consultancy, adding that It is important to know that save for the cases of permanent establishments, the regime is largely an all-in or all-out regime.

Outlining the condition for disqualification, Vanhee said: “If a free zone entity earns non-qualifying income which crosses the threshold of Dh5 million or 5 per cent of its overall income, then the free zone entity’s income is entirely disqualified.”

Nimish Goel, partner at WTS Dhruva, said FTA’s new guide addresses several grey areas like the availability of zero per cent corporate tax benefit on high sea sales, domestic bills to export outside the UAE mainland, and investment in cryptocurrencies.

“Free Zone businesses must note that interest income from surplus funds is non-qualifying. Free zone holding companies with no employees can now clearly meet the substance test based on director decisions – a big win!”, he said.

Free zone vs designated zone

Thomas Vanhee advised taxpayers to verify with their free zones if they’re considered a free zone or designated zone for corporate income tax purposes.

“For the distribution of goods from a designated zone to constitute a qualifying activity, there is no need for the goods to physically come to the UAE with third country trading (high sea sales). Equally, if purchases are made by a free zone company in a designated zone, the goods can come from the mainland and be exported and still conduct a qualifying activity. Even if goods go from mainland to mainland, the activity would qualify. Equally so, goods imported into the designated zone and subsequently imported would constitute qualifying activity,” said Vanhee.

He elaborated that the processing of goods is defined as a wider concept than just manufacturing.

“Important for commodities traders is that there is no need for the goods to be actually traded on a commodity exchange, it’s sufficient that they may be tradable. This is important for oil and gas, gold, and agricultural products. If a free zone person does not earn any qualifying income in a certain period because it has not started to derive income yet, it doesn’t disqualify them immediately from the qualifying free zone person status.”

He added that investing for yourself (e.g. excess cash) as a free zone person is considered financing to “related parties” and therefore a qualifying activity.

A qualifying free zone person is not required to prepare separate financial statements for its qualifying income and its other income, added Vanhee.

Source:https://www.khaleejtimes.com/uae/uae-new-tax-exemption-rules-issued-for-companies-in-free-zones

UAE Corporate Tax: Will all ‘director’s fees’ be exempt from tax?

Business owners need to check whether no tax on director’s fees applies in all matters

Taxation on an individual’s earnings from company directorship services is once again in the spotlight. On May 13, the UAE’s Federal Tax Authority issued an updated public clarification on the VAT implications from ‘performing the function of director’.

With effect from January 1, 2023, the functions of a member of a board of directors are not considered as a supply of services for VAT purposes. So, VAT was thereafter not applicable on the fee received by such individuals for directorship services. The new update replaces the earlier clarification on the matter to expand the scope of the VAT exclusion.

As per the clarification, the exclusion from VAT extends to services performed as a member of a committee derived from the same board of directors on which the individual serves as a director. As a result, the fee/remuneration for the services to the board of directors – and any committee derived from it – will not be subjected to VAT. The clarification has brought much-needed tax relief to many individuals and senior management personnel.

Critical issues

The relief provided by the recent clarification is an opportunity for business owners to review the tax implications – both VAT and corporate tax – on their earnings.

The VAT exclusion applies only on services performed in the formal capacity as a director on a board of directors. Many individual business owners withdraw funds from their business – often labelled as ‘director’s fee’ – without constituting a board of directors for the company. One needs to examine if such owners could still be considered as ‘directors’ and the fee drawn be excluded from VAT in the absence of a board of directors.

While referring to freelance services rendered by an individual who is not a director, the clarification intriguingly refers to ‘third-party’ individuals. Whether an owner-director could still be excluded from VAT without being a member of a board of directors remains a moot question.

Other services provided by an individual – and activities that qualify as a supply of goods/services such as renting of commercial property – may still be subject to VAT upon meeting the conditions for taxable supplies as stated in the VAT laws.

The fee paid to non-resident directors such as those of multinational companies would neither attract VAT under the reverse charge mechanism (RCM) nor mandate such overseas individuals to register for the UAE VAT regime.

There has been no change in the explanation of transitional provisions in the updated clarification to determine the taxability of services performed prior to January 1, 2023.

Corporate tax on individuals

While VAT is applicable on a supply of goods or services for consideration, the supply should be by a person conducting business in the UAE. This is one of the vital elements for being subject to VAT.

Corporate tax applies on persons conducting business or business activity in the UAE. The expression ‘business’ has been defined similarly under VAT as well as the corporate tax laws.

The recent guide on taxation of natural persons under the corporate tax law states that, generally, director fees will not be considered as a business or business activity, and therefore would not be subject to corporate tax. The VAT amendment states that the performance of a director’s function shall not be considered to be a supply of services, which would inherently mean that the individual is otherwise conducting a business.

The position under VAT and corporate tax laws needs to be harmonised. Will the exclusion from corporate tax apply only if an individual is a member of board of directors? In the absence of a formal board of directors, will the funds drawn as director’s fees be subjected to corporate tax in the individual’s hands or be treated as dividends for the company?

If director’s fee will not be considered as a business, can a legal person who provides directorship services – by delegating a natural person to act as director – be subject to VAT?

These are just some of the pertinent questions that business owners need to ask to optimise the VAT and corporate tax implications on their remunerations.

UAE Corporate Tax: ‘Black points’ to be issued to tax agents for wrong advice from July 1

Dubai: The operations of registered ‘tax agents’ in the UAE have been tightened up further, with recent guidelines issued on penalties that will be imposed on wrongful advice to clients on their corporate tax obligations. The penalties – in the form of ‘black points’ – will come into effect July 1.

This is on top of the requirements mandated for those who wish to be practicing tax agents in the UAE.

“The Federal Tax Authority (FTA) is raising the bar by introducing a code of conduct for tax agents that are in line with international standards,” said Jeet Gianchandani, Chairman of the consultancy JCA. “These black points will be applied to tax agents – individual or a business – for various acts of misconduct and negligence.

“This includes wrong advice to clients, and which might result in financial costs for them. The new FTA standards will make tax agents update their knowledge continuously.”

How FTA’s new ‘black points’ will be applied

- If a violation is committed by an agent who does not work for that corporate entity, black points shall be applied to the individual.

- If a violation is committed by an agent who works for the client, black points shall be applied to both the individual and the corporate client.

- If a violation is committed by a representative of a corporate tax agent – and such violation is related to or affecting the client – black points shall be applied to both the individual tax agent appointed to represent the client and the tax agency.

- If the violation is committed by a representative working for a tax agency – and such violation is not relating to or affecting the client represented by the agency – black points shall be applied only to the individual tax agent.

These black points will be applied to tax agents – individual or a business – for various acts of misconduct and negligence.

– Jeet Gianchandani of JCA

More responsibilites on tax agents

Getting to be a registered tax agent in the UAE already requires individuals to put in a set number of hours, etc. “Nowadays, many professional institutes have made it mandatory for their members to attend educational conferences or seminars to score a minimum number of hours, known as CPE (continuous practice education) hours,” said Gianchandani. “CAs (chartered accounts) have to score 60 hours in a year – and the UAE Ministry of Economy requires 30 hours of training in a year.”

“Clearly, not any Tom, Dick or Harry can become a tax agent.”

Who qualifies to be a tax agent?

Tax agents are an intrinsic part of the unfolding corporate tax regime in the UAE. As per the FTA, they will represent clients before the authority and will oversee the filing of their annual tax returns.

In fact, it is prohibited to practice as a tax agent without completing the registration and receiving an accreditation from the FTA.

- A Bachelor’s or Master’s degree in tax, accounting or law from a recognised educational institution. Or a tax certification from an internationally known tax institution if the Bachelor’s degree is in any other field.

- Recent professional experience of at least three years in either tax, accounting or law.

- Language proficiency document for both Arabic and English, written and spoken.

Penalties on tax agents also come into effect for other acts of omission or commission.

Now, if a tax agent is found to have shared info about the client – or for that matter, any tax payer – with a third-party without their explicit consent in writing, they will face a point deduction of 100 points. (The exception is when agents have a reason to disclose under a ‘legal, professional or regulatory obligation’.)

And 200 points will be docked if tax agents promote, design or jointly design ‘aggressive tax planning’ and which is marketed to a number of taxpayers. If this is done with an ‘intention’ to breach any law or which would jeopardise the ‘integrity of the tax system or result in a loss of revenuedue to the FTA’.

UAE corporate tax: Registration, deadlines explained

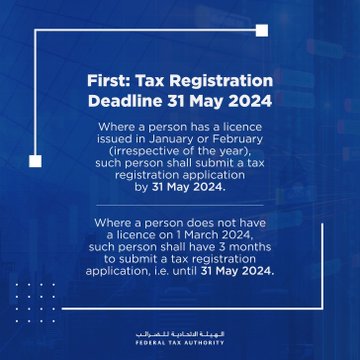

If a person has a licence issued in January or February (irrespective of the year), he has to submit a tax registration application by May 31, 2024

The Federal Tax Authority has reitreated deadlines for the registration of taxable persons for corporate tax.

The announcement on X, as part of FTA’s awareness campaign to help taxpayers meet their tax obligations under the Corporate Tax law, are for resident juridical persons that were incorporated or otherwise established or recognised prior to March 1 2024.

The tax are based on the date their licence was issued.

According to the tax authority, if a person has a licence issued in January or February (irrespective of the year), such person shall submit a tax registration application by May 31, 2024.

In case a person does not have a licence on March 1, 2024, such a person shall have three months to submit a tax registration application until May 31, 2024.

The FTA also posted month-wise tax registration deadlines.