Application of corporate tax on the individuals and legal persons

If the individual is conducting any commercial activity which requires a licence from the related authorities, the individual would be required to take the permit, and the UAE source income of the individual would be subject to corporate tax

The persons subject to corporate tax (CT), can be classified into natural persons and legal persons. The natural persons who fulfil the criteria would fall under the scope of CT, and in the same way, the legal persons that satisfy the specific conditions would be subject to CT. On the other hand, natural and legal persons who do not meet the criteria would be exempt from CT. In this article, we have covered the proposed treatment of CT on natural persons and legal persons.

Application of CT on the natural person:

The individuals can conduct some activities in the UAE without taking a commercial licence/permit, and such income of individuals would not be subject to CT. For example, individuals’ employment income, dividend income, rental income from the investment in the property and other investment income.

If the investments in the real estate and other areas are held through a private or family trust on behalf of individual beneficiaries, the trust would be subject to the same CT treatment like for a natural person. If the individual family members own the property/properties, they can create trust and shift all their properties under the trust. The trust would be managing all such properties on behalf of the individuals who would be beneficiaries of the income. Such income of the trust will not be subject to CT.

Application of CT on the legal person:

The legal persons can be classified into incorporated persons like limited liability companies (LLC), public joint-stock companies (PJSC), private shareholding companies etc. and unincorporated persons like partnerships, joint ventures (JVs) and associations of persons (AoP). The incorporated persons may be incorporated in the UAE or out of the UAE. If the legal persons are incorporated in the UAE, their worldwide income will be subject to CT, and if the businesses are incorporated out of the UAE, still their income would be subject to CT in the UAE if these businesses:

• are being controlled and managed in the UAE (worldwide income will be subject to CT).

• have Permanent establishment in the UAE (UAE source income will be subject to CT)

• earn any UAE source income (UAE source income will be subject to CT)

Like incorporated persons, unincorporated persons like partnerships, JVs, and AoP may be in the UAE or out of the UAE. If these are in the UAE, businesses would be required to assess whether their partners have limited or unlimited liability. If any of the partners have unlimited liability, these entities are called “transparent” and their income would be subject to CT in the hands of the partners or members. This means that these entities will not be subject to CT but their net taxable income will be subject to CT in the hands of the partners or members. On the other hand, where the liability of all partners is limited, such partnerships will be treated like an incorporated company in the UAE.

If the partners or members are living in the UAE, and unincorporated persons are located out of the UAE, then some countries may treat them as “transparent” entities and others may treat them as a company. Such non-resident unincorporated persons will have the same CT treatment in the UAE like these will have in their respective countries.

The businesses and natural persons are required to assess their status and be prepared for the CT accordingly.

Source:https://www.khaleejtimes.com/finance/application-of-corporate-tax-on-the-individuals-and-legal-persons

Overview of the corporate tax public consultation document

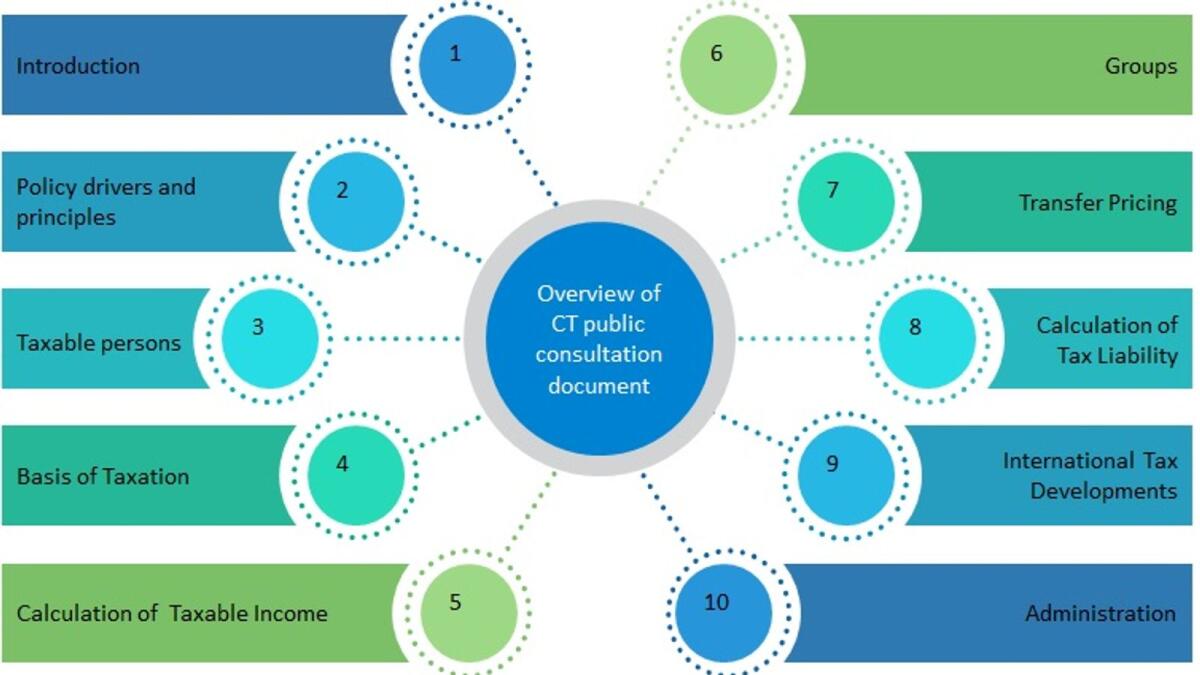

The consultation document is containing 10 sections starting from the introduction and ending with the administration

On January 31, 2022, the Ministry of Finance (MoF) announced that the UAE will introduce the corporate tax on the taxable profits of the businesses effective from the financial year starting on or after June 01, 2023. In continuation of the finalisation of the UAE corporate tax (CT) regime, on April 28, 2022, the MoF issued the public consultation document to seek the opinion of the stakeholders on the main features and smooth implementation of the corporate tax which would be helpful for the MoF to receive input from the interested parties and make informed decisions.

The consultation document is containing 10 sections starting from the introduction and ending with the administration. In the first and second sections of the consultation document, MoF has highlighted the purpose of issuing the consultation document and the rationale behind the issuance of CT regime in the UAE respectively.

• have Permanent establishment in the UAE (UAE source income will be subject to CT)

• earn any UAE source income (UAE source income will be subject to CT)

The tax on unincorporated partnerships, joint ventures and associations of persons depends upon their presence and liability of their partners.

The fourth section covers the definition of residents and non-residents. The legal persons incorporated in the UAE will automatically be considered residents. The foreign companies will be UAE residents if effectively managed and controlled in the UAE. The natural person who is engaged in business or commercial activity in the UAE will be a UAE resident. Anyone who is not a resident will be considered a non-resident. The residents are taxable in the UAE on their worldwide income and non-residents will be subject to tax in UAE on taxable income of their PE in the UAE and UAE sourced income.

The fifth section contains the approach to calculate the taxable income which states that financial statements profits calculated as per IFRS will be adjusted to arrive at the taxable income.

In the sixth section, it has been given that the UAE resident group of companies can form a tax group and be treated as a single taxable person. Moreover, it covers the conditions to enter into the tax group. The rules related to the transfer of losses, group relief and restructuring relief has been given in detail.

The seventh section highlights that there would be transfer pricing rules and transactions between the related parties would be on an arms-length basis. Arm length principles and documents requirement has been given in this section as well.

In the eighth section, it has been given that the zero per cent tax would be applicable on the taxable income up to Dh375,000, and any taxable income beyond Dh375,000 would be subject to tax at the rate of nine per cent. The zero per cent withholding tax would apply to the following domestic and cross border payments made by the UAE businesses:

• UAE sourced income earned by a foreign company that is not attributable to a PE in the UAE of that foreign company.

• Mainland UAE sourced income earned by a Free Zone Person that benefits from the zero per cent CT regime

• Dividends and other profit distributions made by a Free Zone Person that benefits from the zero per cent

TThe UAE and over 130 other countries reached an agreement on BEPS 2.0. The ninth section will cover the proposed approach by the UAE to respond to BEPS 2.0, and set the basis for the reallocation of profits from where sales arises and the requirement for the global minimum tax of fifteen per cent

A business subject to CT will need to register with the FTA and obtain a tax registration number. Every registered business will be required to file an annual tax return and make payment within nine months from the end of the relevant financial year, and it has been given in the last section of the public consultation document.

Source:https://www.khaleejtimes.com/finance/overview-of-the-corporate-tax-public-consultation-document?_refresh=true

Compliance of economic substance regulations is a must to avoid penalties

Non-compliance with the ESR is subject to penalties ranging from Dh20,000 to D400,000. To avoid this, it is recommended that the licensee must comply with the ESR.

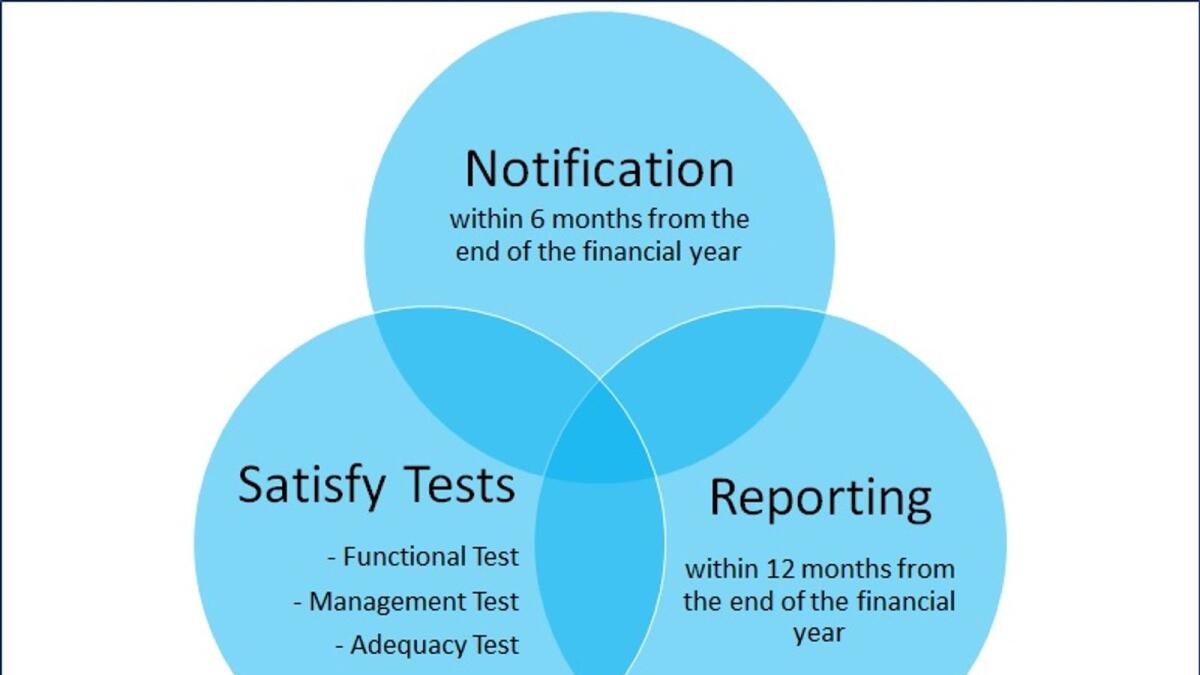

As discussed in our previous article, every licensee who earns relevant income from a relevant activity should submit notification within six months from the end of the relevant financial year, satisfy the economic substance test and submit the report within twelve months from the end of the relevant financial year.

The term licensee, with certain exceptions, means a juridical person (a legal entity — incorporated inside or outside the state); or an unincorporated partnership registered in the state, including a free zone and financial free zone, and conducts relevant activity.

The term relevant income means all gross income from a relevant activity recorded in the books of the licensee, and the word relevant activity means any of the nine specific activities mentioned in our previous article which we will discuss in detail in the future.

ESR notification

The notification is required to be submitted within six months from the end of the relevant financial year. The notification requires some basic information like licensee name, commercial license number, regulatory authority, legal status, information about the relevant activity, ownership and ultimate ownership, parent company and ultimate parent company etc. of the licensee. The notification requires to be submitted online on the Ministry of Finance (MoF) portal. As far as information about the relevant activity is concerned, the license is required to acknowledge relevant activity/activities executed by the licensee, and acceptance about the relevant income earned during the reportable period. The reporting of the financial numbers is not required in the notification but acknowledgement/acceptance of the relevant activity and relevant income.

ESR testing

The licensee is required to comply with the (i) functional test, (ii) management test and (iii) adequacy test. The licensee who earns relevant income from the relevant activity is compulsorily required to comply with these tests.

The functional test requires that the licensee conducts Core Income-Generating Activity/Activities (CIGA) in the State. If the CIGA is being conducted out of the United Arab Emirates (UAE), the licensee would be considered non-compliant, and it would attract penalties accordingly. Compliance with this test is not required in the case of holding company relevant activity. This means, that the CIGA related to the purely holding company business can be conducted out of the UAE, and it would not be considered non-compliance.

The management test demands that the licensee is being directed and managed in the UAE. The direction and management require that there should be adequate (at least one) board meeting in the UAE in a year. In the board meeting, there should be a full quorum and directors should be physically present. If the licensee is managed by its shareholders/owners/partners, then these requirements will be fully applicable possible to the manager/managers.

Moreover, the law demands that minutes of the meeting should be taken and should be in writing. The minutes should be signed by all directors attending the meetings. The minutes record the making of strategic decisions taken in the meeting. Minutes of all board meetings and related records should be kept in the UAE. The ESR law requires that the directors of the licensee have the necessary knowledge and expertise to discharge their duties.

Under the adequacy test, the licensee must have (i) adequate employees, (ii) adequate operating expenditures, and (iii) adequate physical assets. The law requires that the licensee or the third party to whom work has been outsourced must have an adequate number of qualified full-time employees who are physically present in the UAE. The employee can be employed by the licensee or third party, temporary contract, or long-term contract.

Moreover, the law requires that the licensee or third party to whom work has been outsourced must have adequate operating expenditure in the state. To comply with the law the licensee or third party must have adequate physical assets in the state. The physical assets include offices or business premises, and such premises may be owned or leased by the licensee.

ESR report

As mentioned above, the licensee is required to submit the report within 12 months from the end of the relevant financial year. The report is required to be submitted on the MoF portal. In the report, along with the basic information, the licensee is required to provide the financial information like the amount of revenue earned from the relevant activity/activities, number of employees, number of meetings etc. that we will discuss in detail in our next articles.

Non-compliance with the ESR is subject to penalties ranging from Dh20,000 to D400,000. To avoid this, it is recommended that the licensee must comply with the ESR.

Source:https://www.khaleejtimes.com/finance/compliance-of-economic-substance-regulations-is-a-must-to-avoid-penalties

What is Fatca

The US, the Philippines, North Korea, Libya and Eritrea are some of the countries which charge a tax on the global revenue of their citizens and residents

The United States (US) is the only major country that applies a tax on the worldwide income of its citizens and tax residents. The other countries which charge a tax on the global revenue of their citizens and residents are the Philippines, North Korea, Libya and Eritrea.

If they are living abroad and earning any income, the US citizens are liable to submit the annual tax return to Internal Revenue Service (IRS). In addition, the US taxpayers who own foreign accounts are responsible for reporting those accounts to the US treasury department.

To avoid tax evasion, the US government introduced the Foreign Account Tax Compliance Act (Fatca) in 2010, which requires Foreign Financial Institutions (FFIs) to report information about financial accounts held by US taxpayers or by foreign entities in which US taxpayers have a substantial ownership interest. Unless exempt, FFIs that do not comply with the Fatca, 30 per cent withholding tax applies to their US source payments made to them.

FFIs can submit this information directly to the IRS by logging in to their portal or through the competent authority of the respective country where the Intergovernmental Agreements (IGA) are in place. Including China, 113 jurisdictions have signed the IGA to comply with Fatca, and the UAE is one of them.

The UAE signed IGA with the US government (US-UAE IGA) on June 17, 2015. Being a competent authority, the Ministry of Finance in the UAE, issued guidance on the UAE IGA on July 6, 2015.

In the IGA, both of the parties have agreed that the UAE will collect and exchange the information on each “US Reportable Account” on an annual basis with the US relevant authority, and the US Reportable Account has been defined as under in the IGA: “Financial Account maintained by a Reporting UAE Financial Institution and held by one or more Specified US Persons or by a non-US entity with one or more controlling persons that is a specified US person”.

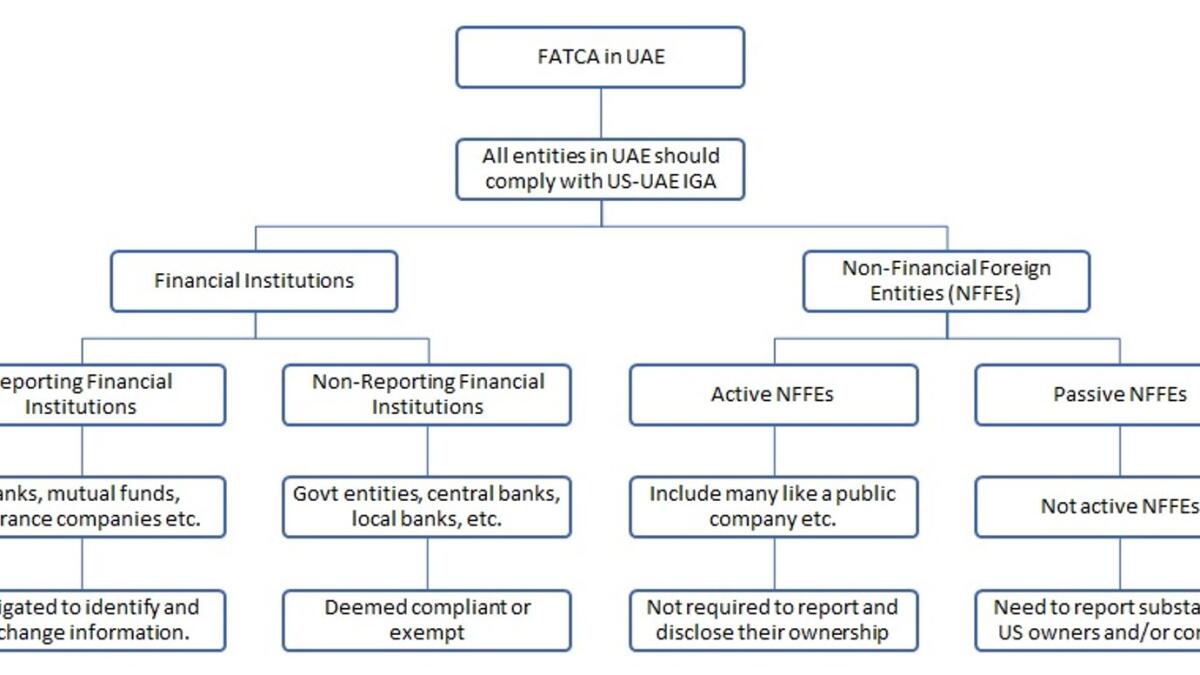

Under the UAE Law, all entities within the UAE should comply with the US-UAE IGA, and the entities can be classified into (i) Financial Institutions (FIs) and (ii) Non-Financial Foreign Entities (NFFEs).

FIs can be categorised as (i) Reporting FIs, and (ii) Non-Reporting FIs. Each reporting FI shall be treated as complying with Fatca, and 30 per cent tax will not be held on the US source payment if the related information has been provided by the UAE government within the due date and the reporting FI comply certain conditions. Each non-reporting FI shall be deemed compliant or exempt beneficial owner.

Non-reporting FIs are generally not required to report information to the UAE; however, they will need to provide properly completed US tax forms or self-certifications to avoid Fatca withholding on US source payments to them. The key example of non-reporting FIs as given in the annexure-II of US-UAE IGA are government entities, intergovernmental organizations, central bank, FIs with a local client base, local bank, FI with only low-value accounts etc.

Non-US entities that are not FIs are considered to be Non-Financial Foreign Entities (NFFEs) which can be classified as (i) Active NFFEs and (ii) Passive NFFEs.

An “Active NFFE” means any NFFE that meets any of the criteria like less than 50 per cent of their gross income is passive income and less than 50 per cent assets are held to produce passive income, the stock of the NFFE is regularly traded on an established securities market or the NFFE is a related entity of an entity the stock of which is regularly traded on an established securities market, the NFFE is a government or part of the government, the NFFE is organised in a US territory and all of the owners of the payee are bona fide residents, of that US territory; etc.

All active NFFEs doesn’t require any Fatca reporting but properly completed US tax forms or self-certification is required in order to avoid Fatca withholding on US source payments to them. Any NFFE which is not active will be considered passive NFFE. All passive NFFEs are required to identify and exchange information about their substantial US owners and/or controlling persons who are specified US persons.

Regulated entities will be regulated by their regulators. All economic department entities will be governed by the Federal Ministry of economy, and all freezone entities will be managed by the respective freezones authorities for the compliance and enforcement of Fatca.

Source:https://www.khaleejtimes.com/finance/what-is-fatca