Corporate tax: A sign of a credible economy

Every business registered in the UAE, either on the mainland or in the free zone, would be liable to register for CT purposes

The Ministry of Finance of the UAE has made an announcement on January 31, 2022, for the implementation of federal corporate tax (CT) effective from the financial years starting on or after June 1, 2023, to cement its position as a world-leading hub for businesses and investments. The introduction of CT would be helpful to meet international standards to bring transparency and prevent harmful tax practices.

CT is already in place in four Gulf Cooperation Council countries, and the UAE is the fifth country that has joined the club. At the moment, there is no CT in Bahrain.

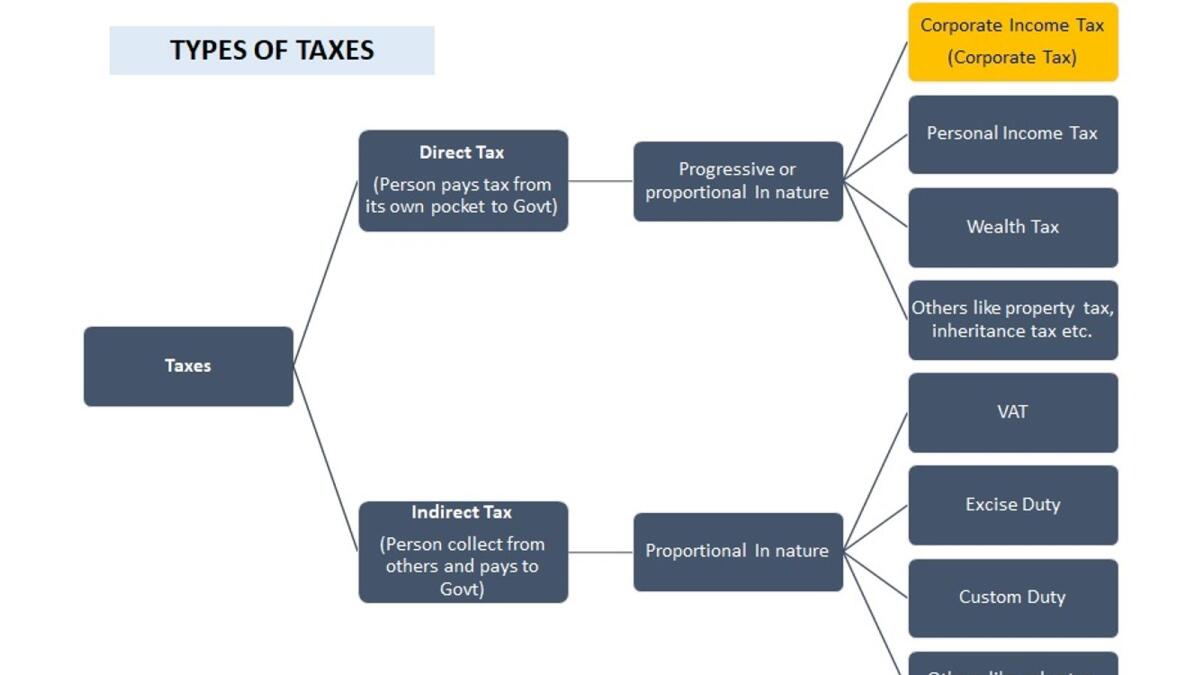

CT is a proportional direct tax (flat-rate tax) that applies to the adjusted taxable profits of the corporations. In some jurisdictions, this is called company tax or business tax. CT is different from the personal income tax which applies to the income of the individuals. CT is different from the value-added tax (VAT) as well which is an indirect consumption tax. CT is not a replacement for VAT, but both taxes would be in place at the same time.

Every business registered in the UAE (except companies involved in the extraction of natural resources), either on the mainland or in the free zone, would be liable to register for CT purposes, and they would be responsible to submit their annual CT return and pay the CT payment accordingly. The group companies, which are under common control and/or common ownership, would be able to get single CT registration, and they would be liable to submit a single return on an annual basis. This would be quite helpful for the group companies as the tax losses of group entities would be adjusted against the taxable profits of other entities of the same group which would reduce the tax base and ultimately, lead to lesser tax on their taxable profits.

To support small businesses and startups, zero per cent CT would be applicable on taxable income of up to Dh375,000, and any taxable income exceeding Dh 375,000 would be subject to tax at a flat rate of nine per cent. A different rate would be announced for the multinational entities that meet the criteria of pillar II companies according to the Organisation for Economic Cooperation and Development (‘OECD’) guidelines, which requires establishing a minimum level of taxation on multinational companies doing business around the world.

CT would not be applicable on the individuals’ income from salaries, real estate, investment in shares or other personal income not related to the UAE trade or business. However, if the individuals have taken the business licence and conducting commercial activity even as a freelancer, they would be liable to register, and their taxable income would be subject to tax based on the aforesaid criteria.

Foreign investors who do not carry on the business in the UAE, would not be subject to corporate tax. Advances would not be subject to CT, and the companies would be able to carry forward their losses up to a certain period, and the Laws and related Regulations would provide more detail about this. Withholding tax would not be applicable on the local and cross border transactions which would be helpful for the UAE to maintain its position as a global hub for businesses. There would not be CT on the capital gain (gain on the sales of the capital assets) and dividend received by the UAE businesses from their foreign investments.

There are more than 40 free zones in the UAE, and each free zone has its own framework. Based on these frameworks, the income of the businesses is not subject to corporate tax for a specific period. According to the press release, free zone businesses that meet all necessary requirements would continue to benefit from the corporate tax incentives. The companies which engage in the extraction of natural resources would be exempt from the CT but on these companies, respective Emirates Law would be applicable.

CT would apply to the adjusted taxable profits. Businesses would be required to prepare the financials as per applicable International Financial Reporting Standards (IFRS), and these financials would require adjustments to arrive at the taxable profits. The mapping of accounting numbers into tax numbers is always a challenging exercise since the basis of preparation of financial statements as per IFRS are different from the requirement of tax authorities. Like IFRS follows an accrual basis while tax authorities usually follow a cash basis. CT Law and related Regulations would provide a detailed understanding of the adjustments and exemptions available to arrive at the taxable profits.

Businesses would be required to have proper impact assessment and they would be required to tweak their processes for the proper incorporation of CT in the organization. Companies need to train their staff and calculate the impact on their working capital. Profit shifting through non-arm’s length pricing would have an impact on the tax base which would affect the tax amount, so transfer pricing rules would be required to be implemented properly. Compliance and operating costs of the businesses would go up, but it would bring more transparency and credibility to their results.

Source:https://www.khaleejtimes.com/finance/corporate-tax-a-sign-of-a-credible-economy

What are the major impacts of VAT

In this article, KT has assessed the impact of VAT on businesses, individuals, government and overall economy

Since VAT is a consumption and multistage tax, so it has an impact on each player of the supply chain and individuals, who are buying the goods and services for consumption purposes. It has an effect on the economy and it is a major source of revenue for the government. In this article, we have assessed the impact of VAT on businesses, individuals, government and overall economy.

(a) Impact of VAT on businesses

There are some common impacts of VAT on each business and some specific impacts, based on the categories of supplies.

(i) Common Impacts of VAT on Businesses

Whenever VAT is being introduced in any country, every business is required to have an impact assessment to assess the impact of VAT. Based on the impact assessment, they will be able to know, on which areas of business VAT will have an impact and what are they required to do to implement it properly. Like based on the impact assessment, they will be able to adopt the proper tax position of their supplies. Businesses will be able to know eligibility of VAT registration, impact on their working capital and system, required changes in the processes, compliance requirement etc.

Based on the impact assessment, businesses are required to implement the VAT properly which requires changes in the system, tweaking existing processes, training to the employees, communication with the suppliers and customers etc.

Once the VAT is up and running, businesses are required to submit the VAT Return, and while submitting the VAT returns, businesses cannot claim input tax on some purchases/expenses like expenses for throwing parties, expenses related to Car which can carry less than 10 people and is available for personal use, expenses related to the dependents of the employees where companies have no legal obligations, non-business expenses etc. All such blocked input tax will become cost of the businesses.

Businesses requires work force to comply VAT so it will lead to increase in administration and hiring cost. Sometime, companies are required to hire consultants which will lead to increase the consultancy charges.

(ii) Specific impact of VAT on businesses

So far as specific impact of VAT is concerned on businesses based on the categories of supplies, the industries that are dealing with standard rated supplies, VAT will impact the purchasing power of their customers and it will have a negative effect on the demand of their supplies. VAT registered companies which have longer payment terms with the customers and shorter payment terms with the suppliers, VAT will have adverse impact on their working capital, and vice versa.

Businesses which are dealing with the exempt supplies, like local passenger’s transport, banks and financial institutions offering margin-based services, suppliers of bare land etc will not be able to claim related input tax and such input tax will become their cost which will lead to increase in the operating cost of the business. Most probably, such businesses will pass on this cost to their customers by increasing the prices of their supplies to achieve their targeted margins so it will have a negative impact on the purchasing power of their customers which will affect demand of their supplies.

Businesses that are dealing with zero rated and out of scope supplies, VAT will not have any major impacts on them except the common impacts as mentioned above.

(b) Impact of VAT on individuals

Individuals who are buying standard rated goods and services for consumption purposes, they would be liable to pay five per cent VAT, and Individuals who are buying VAT exempt goods and services, most probably, they would be liable to pay higher prices. Such purchases will have a negative impact on their purchasing power. However, if they are buying zero rated or out of scope supplies, they wouldn’t be liable to pay any VAT and/or increased price which will not have impact on them.

(c) Impact of VAT on the government

Globally, taxes are the major source of revenue for the Governments and Governments across the globe spend these taxes for the welfare of the public. In the same way, VAT has become a source of income for the Government of United Arab Emirates (UAE) and UAE Government spends this income for the welfare of the public by developing world-class infrastructure, hospital, roads, medical facilities etc.

Moreover, VAT has reduced reliance on the oil-generated money and led to diversified sources of income for the Government which is a sign of healthy and matured economy.

(d) Impact of VAT on the economy

I am always saying, this is not only introduction of VAT, but the documentation of the whole economy. Government will be able to know the sales and purchases of each registered supplier in the supply chain, which would be helpful for the Government to take decisions.

Moreover, standard rated and exempt supplies of goods and services will make supplies more expensive and it will push the inflation rate up based on average supply of standard rated goods and services in the market.

Source:https://www.khaleejtimes.com/business/what-are-the-major-impacts-of-vat

Does serving a notice period come under VAT’s coverage?

An employment contract between an employee and employer is outside the scope of VAT. This is a universally recognized principle and always mentioned in the VAT legislation.

Although the UAE VAT Law does not specifically define employment contracts as outside the scope of VAT, the Taxable Person Guide clarifies this. Under the UAE VAT Law, a supply must be made by a person conducting business – i.e., any regular or ongoing activity conducted with a degree of independence and continuity. Due to the requirement that a business must be an independent activity, the activities of employees are not treated as being in the course of business.

As such, employees are not liable to charge VAT on their remuneration or salary. Having said that, there are certain transactions between the employee and employer that occur outside the employment contract.

Liable for recovery

An organisation may recover from an employee: visa charges for dependents, personal mobile expenses, insurance of employee dependents, vehicle usage charges, etc. We will discuss the VAT treatment of recoveries made by organisations in lieu of employees not serving their full notice period.

When an employee resigns, in the normal course of business, the employee must serve a notice period, as may be mutually agreed in the employment contract. During the notice period, he or she should be present on all the working days.

In certain situations, the employee may not want to serve all or part of the notice period. In which case, either the employer waives off the requirement of servicing the entire notice period, or the employee may be asked to pay an amount equivalent to the salary of the unserved notice period. The question that arises is whether the money received by the organisation for the unserved notice period constitutes consideration for a ‘supply’?

Compensation

Article 119 of the Employment Law provides that if the employer or the employee has failed to serve notice to the other party for termination of the employment contract, the party obliged to serve the notice period shall pay to the other party compensation known as ‘compensation in lieu of notice’ equal to the pay for the unserved notice period. Such compensation is payable even if such failure to notice or such reduction of the period does not cause damage to the other party.

From a VAT perspective, one may be tempted to refer to the VAT Public Clarification on VAT Treatment of Compensation-type payments issued by the Federal Tax Authority (FTA). The Guide clarifies that:

- A fine or penalty may be imposed for contravening the terms of an agreement.

- Where a person has caused damage to another person, the person causing damage may be required to make a payment to compensate for such damage or loss.

The Guide provides that fines and penalties are not a consideration for any supply, and therefore outside the scope of VAT. Also, where the payment is compensation for breaching pre-existing terms of a contract, it is unlikely to be a consideration for a supply and therefore outside VAT’s scope.

If one were to closely read the provisions of UAE Employment Law, the compensation is payable even if such failure to notice or such reduction of the period does not cause damage to the other party. Therefore, one could argue that compensation in lieu of an unserved notice period is not a fine or payment in lieu of damages. It is to be seen if the FTA will refer to the provisions of employment laws to evaluate whether a payment is a fine or a payment in lieu of damages.

One may note that the UAE VAT Regulations define ‘Supply of Services’ to include cessation or surrender of a right. In the case of notice pay recovery, one may argue that the organisation is giving up its right to an employee serving the notice period, in lieu of consideration, and hence the same would be taxable at 5 per cent.

Not swayed by descriptions

In considering whether a payment is a consideration for a supply or is in the nature of penalty, it is important to ignore the labels or titles given to a payment. A description of a receipt as ‘penalty’ or ‘compensation in lieu of damages’ will not prevent the nature of the payment from being considered for a supply.

The VAT treatment of recovery of notice pay must be considered in conjunction with the rights of the employer, employee, employment contract and the local labour laws. There may not be a universal answer, and each situation must be evaluated on its own facts.

Source:https://gulfnews.com/business/analysis/does-serving-a-notice-period-come-under-vats-coverage-1.1636013253767

India cuts taxes on petrol, diesel ahead of Diwali to boost economy

The Indian government on Wednesday reduced taxes on petrol and diesel in a bid to improve consumer sentiment, as Asia’s third-largest economy recovers from the shocks of severe lockdowns to control the spread of the coronavirus.

The excise duty on petrol has been reduced by Rs5 ($0.0671) per litre, and that on diesel by Rs10 ($0.1342) per litre, the government said in a statement.

Following the federal move, at least ten states ruled by Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP), or his allies, said late Wednesday they would go further and reduce local fuel taxes by as much as Rs7 a litre.

The tax relief comes on the eve of the Hindu festival of Diwali, which marks the beginning of a busy festive season in India, typically marked by increased consumer spending.

Recent months have witnessed a steady growth in consumer spending in India, with a relaxation on curbs on travel and business operations due to a dip in the number of coronavirus cases.

But high fuel prices have been hurting the margins of corporates as well as farmers, who contribute a significant chunk to the economy. The cut in fuel taxes is likely to come as a boost to manufacturers and farmers.

“Given that inflation expectation is building up, there was a need to relook at the tax component,” said NR Bhanumurthy, economist and vice chancellor at the Bengaluru-based BR Ambedkar School of Economics. “This will cool down the inflation expectation to some extent, which will augur well for sustained GDP (gross domestic product) growth.”

Modi’s government has faced increasing criticism from its main opposition Congress party over rising fuel prices in recent weeks. In a country where a majority of the people live on less than $2 a day, taxes make up a large component of fuel prices: a litre of petrol comes at Rs110.04 while diesel comes at Rs98.42 in New Delhi.

Before the cut to prices announced on Wednesday, taxes made up about 52 per cent of the price of petrol and about 47 per cent of that of diesel.

Spiking global oil prices have pushed up the retail prices of petrol and diesel to a record high this month in India, which is the world’s third-biggest oil importer and consumer and ships in about 85 per cent of its oil needs from overseas.

Global oil prices surged to $86.40 a barrel on October 26 – the highest since October 2014 – battered by the hit to economies from the Covid-19 pandemic, although they since eased to about $82.5 per barrel.

Source:https://www.khaleejtimes.com/economy/india-cuts-taxes-on-petrol-diesel-ahead-of-diwali-to-boost-economy