Scope of Economic Substance Regulations

If the entities are carrying business only in the UAE, or entities whose income is being taxed in other countries are not subject to ESR in the UAE. ESR is not applicable to natural persons, sole proprietorships, trusts and foundations

In our previous article, we discussed the reasons for implementing Economic Substance Regulations (ESR), which were to counter harmful tax practices and curb tax evasion.

We highlighted that the UAE, being a member of the Organisation of Economic Cooperation and Development (OECD) inclusive framework, introduced ESR law (the Law) under the Cabinet Decision No.31 of 2019, which was replaced by Cabinet Decision No. 57 of 2020. The UAE issued Guidance no. 215 of 2019, which was replaced by MD 100 of 2020 for the smooth implementation of ESR in the UAE.

The law requires that every licensee who earns relevant income from a relevant activity must comply with the followings:

• submit notification within six months from the end of the relevant financial year

• satisfy economic substance test

• submit the report within twelve months from the end of the relevant financial year

The term licensee used above means a juridical person (a legal entity — incorporated inside or outside the state); or an unincorporated partnership registered in the state, including a free zone and financial free zone, and carries out relevant activity.

In the light of the above, any legal entity and unincorporated partnership that meets the above-mentioned criteria can be classified as a licensee, but there are following exceptions to the above definition, and the excepted entities are not required to comply with ESR law and related regulations.

• A licensee that is an investment fund

• A licensee that is a tax resident in a jurisdiction other than a state

• A licensee that is:

o Owned by resident or residents (directly or indirectly) in the state

o It’s not part of the MNE Group (a group that has entities in different jurisdictions or an entity that is tax resident in one jurisdiction and subject to tax in another jurisdiction due to its activities carried through permanent establishment or branch).

o It only carries out business in the state.

• A licensee that is a branch of a foreign entity the relevant income of which is subject to tax in a jurisdiction other than the state; and

• Any other licensee as determined pursuant to the decision of the Minister of Finance

• Sole proprietorships, trusts and foundations

From the above exceptions, it is evident that if the entities are carrying business only in the UAE, or entities whose income is being taxed in other countries are not subject to ESR in the UAE. ESR is not applicable to natural persons, sole proprietorships, trusts and foundations.

The juridical persons and unincorporated partnerships if not earning any relevant income, are not subject to ESR. The entities owned by the government will also be tested based on the above criteria and have not any notable exceptions.

The juridical persons and unincorporated partnerships which are conducting relevant activities and earning relevant income as well can further be classified into exempted entities and non-exempted entities. The exempted entities will have to submit a notification and they will have to prove the reasons for not being subject to ESR. In case of non-compliance, these would be treated as normal licensees. The non-exempted entities will have to submit the ESR notification within six months from the end of the relevant financial years, and if they are earning relevant income, they will have to comply with the ESR test and submit the related report as well within twelve months from the end of the relevant financial years.

The term relevant income means all gross income from a relevant activity that is recorded in the books and records of the licensee or the exempted Licensee under the accounting standards, whether earned in the UAE or outside the UAE and irrespective of whether the entity has derived a profit or loss from its activities. In the context of income from sales or services, gross income means gross revenues from sales or services without deducting the cost of goods sold or the cost of services.

The word relevant activity means any of these nine activities. Like the activity of (i) banking business, (ii) insurance business, (iii) investment fund management business, (iv) lease finance business, (v) headquarters business, (vi) shipping business, (vii) holding company business, (viii) intellectual property business and (ix) distribution and service sector business.

It is recommended to assess your business based on the above criteria to ascertain whether your entity is subject to ESR or not. The entities that are not conducting relevant activities, but their trade license is carrying the relevant activities, it is highly recommended that such entities should submit notification within the due date to avoid penalties.

Source:https://www.khaleejtimes.com/finance/scope-of-economic-substance-regulations

What is Fatca

The US, the Philippines, North Korea, Libya and Eritrea are some of the countries which charge a tax on the global revenue of their citizens and residents

The United States (US) is the only major country that applies a tax on the worldwide income of its citizens and tax residents. The other countries which charge a tax on the global revenue of their citizens and residents are the Philippines, North Korea, Libya and Eritrea.

If they are living abroad and earning any income, the US citizens are liable to submit the annual tax return to Internal Revenue Service (IRS). In addition, the US taxpayers who own foreign accounts are responsible for reporting those accounts to the US treasury department.

To avoid tax evasion, the US government introduced the Foreign Account Tax Compliance Act (Fatca) in 2010, which requires Foreign Financial Institutions (FFIs) to report information about financial accounts held by US taxpayers or by foreign entities in which US taxpayers have a substantial ownership interest. Unless exempt, FFIs that do not comply with the Fatca, 30 per cent withholding tax applies to their US source payments made to them.

FFIs can submit this information directly to the IRS by logging in to their portal or through the competent authority of the respective country where the Intergovernmental Agreements (IGA) are in place. Including China, 113 jurisdictions have signed the IGA to comply with Fatca, and the UAE is one of them.

The UAE signed IGA with the US government (US-UAE IGA) on June 17, 2015. Being a competent authority, the Ministry of Finance in the UAE, issued guidance on the UAE IGA on July 6, 2015.

In the IGA, both of the parties have agreed that the UAE will collect and exchange the information on each “US Reportable Account” on an annual basis with the US relevant authority, and the US Reportable Account has been defined as under in the IGA: “Financial Account maintained by a Reporting UAE Financial Institution and held by one or more Specified US Persons or by a non-US entity with one or more controlling persons that is a specified US person”.

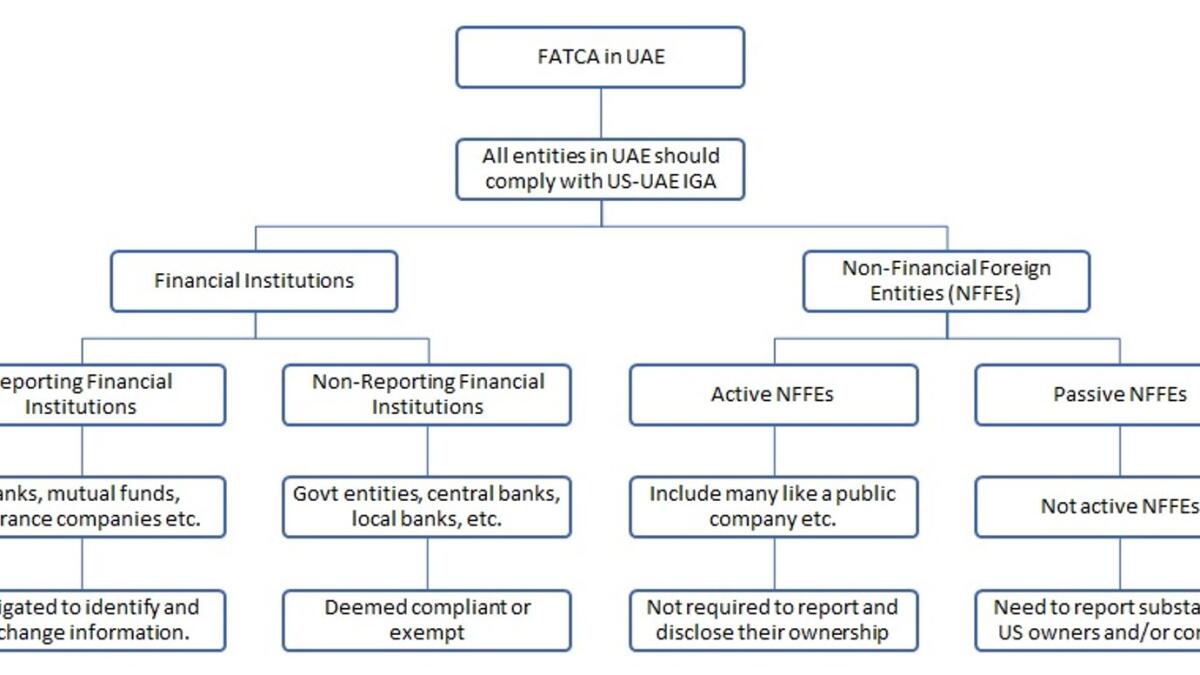

Under the UAE Law, all entities within the UAE should comply with the US-UAE IGA, and the entities can be classified into (i) Financial Institutions (FIs) and (ii) Non-Financial Foreign Entities (NFFEs).

FIs can be categorised as (i) Reporting FIs, and (ii) Non-Reporting FIs. Each reporting FI shall be treated as complying with Fatca, and 30 per cent tax will not be held on the US source payment if the related information has been provided by the UAE government within the due date and the reporting FI comply certain conditions. Each non-reporting FI shall be deemed compliant or exempt beneficial owner.

Non-reporting FIs are generally not required to report information to the UAE; however, they will need to provide properly completed US tax forms or self-certifications to avoid Fatca withholding on US source payments to them. The key example of non-reporting FIs as given in the annexure-II of US-UAE IGA are government entities, intergovernmental organizations, central bank, FIs with a local client base, local bank, FI with only low-value accounts etc.

Non-US entities that are not FIs are considered to be Non-Financial Foreign Entities (NFFEs) which can be classified as (i) Active NFFEs and (ii) Passive NFFEs.

An “Active NFFE” means any NFFE that meets any of the criteria like less than 50 per cent of their gross income is passive income and less than 50 per cent assets are held to produce passive income, the stock of the NFFE is regularly traded on an established securities market or the NFFE is a related entity of an entity the stock of which is regularly traded on an established securities market, the NFFE is a government or part of the government, the NFFE is organised in a US territory and all of the owners of the payee are bona fide residents, of that US territory; etc.

All active NFFEs doesn’t require any Fatca reporting but properly completed US tax forms or self-certification is required in order to avoid Fatca withholding on US source payments to them. Any NFFE which is not active will be considered passive NFFE. All passive NFFEs are required to identify and exchange information about their substantial US owners and/or controlling persons who are specified US persons.

Regulated entities will be regulated by their regulators. All economic department entities will be governed by the Federal Ministry of economy, and all freezone entities will be managed by the respective freezones authorities for the compliance and enforcement of Fatca.

Source:https://www.khaleejtimes.com/finance/what-is-fatca

Star Tech: Why Dubai has become a magnet for entrepreneurs

Majed Al Suwaidi, Managing Director, Dubai Media City explains to Khaleej Times about what makes the Emirate a one-stop destination for startups and entrepreneurs.

Majed Al Suwaidi, Managing Director of Dubai Media City, shares deep insights into the Emirate’s ease of doing business that’s striking a big chord with global innovators and entrepreneurs. in5, an enabling platform for entrepreneurs and startups, also falls under his remit.

Edited excerpts from an exclusive interview:

How conducive is the current landscape in Dubai for startups and entrepreneurs?

The landscape in Dubai is truly ripe for entrepreneurs to realise their ambitions. Dubai has become a magnet for entrepreneurs, thanks to our leadership’s vision and more than two decades of enabling ecosystems boasting world-class infrastructure, a business-friendly environment to fuel success and a culture that embraces innovation.

There are several government-backed initiatives enriching the opportunities available for startups and small and medium enterprises (SMEs).

The Ministry of Economy’s Entrepreneurial Nation has set a goal to nurture 20 unicorns by 2031, alongside a number of incentives for new businesses, while the 10-year Golden Visa and GoFreelance packages further entice independent individuals from around the world to choose Dubai as a place to live, work and invest in the emirate.

Business incubators like in5 further enhance prospects for aspiring entrepreneurs and creatives in technology, media and design by providing valuable launching pads or inventive ideas and business models.

We offer expert advisory and mentorship, access to investment opportunities, networking events and workshops that insert our startups within some of the city’s most active business districts as well as creative facilities with industry-standard equipment. By continuing to invest in our offerings, infrastructure and platform to meet the market’s evolving needs, we hope to boost business growth and reaffirm Dubai’s economic competitiveness on a global scale.

What is a unicorn?

To be considered a unicorn, a business needs to reach an investor valuation of $1 (Dh3.67) billion or more. It’s quite an ambitious goal, but it’s not impossible. Dubai’s robust technology ecosystem and world-class infrastructure play a vital role in helping nurture unicorn companies, such as Careem, which was acquired by Uber in 2019 for $3.1 (Dh11.39) billion. Soon after, Dubai-based Emerging Markets Property Group (EMPG) and OLX Group merged their Middle East and North Africa (MENA) and South Asia operations, Bayut and Dubizzle, resulting in a business valued at Dh3.6 billion.

In 2019, Cisco acquired Voicera, which had initially acquired in5-based startup Wrappup in 2018. Wrappup specialises in using Artificial Intelligence (AI) technologies to transcribe and convert audio recordings into notes. The startup was founded during a hackathon competition organised by in5 in 2015, and in the short span of four years, attracted the interest of the Silicon Valley giant.

Dubai has supported a number of start-ups. How are they faring?

We’re proud to support a number of very promising startups in our community that are leaving quite an impression on their industries. Last year, our startups successfully secured over Dh1.4 billion in funding, and that number is rapidly rising as we attract more and more investments. Agri-tech startup, Desert Control, is listed on Euronext Growth Oslo, a multilateral trading facility operated by the Oslo Stock Exchange, while in5 alum Derq has partnered with driverless technology pioneer Motional to pilot autonomous vehicles with smart infrastructure in Las Vegas. There is much action and promise brewing in our incubator, demonstrating the region’s entrepreneurial spirit.

What are essential traits that put you on track to becoming a unicorn?

Unicorns are traditionally tech-savvy startups that disrupt their market, rewriting how people interact with a certain kind of product or service. Careem is an example which is close to home — the company changed the nature of private transport in the region by bringing cabs directly to a consumer’s doorstep at any time and location, while being upfront about costs.

While that might be a lofty founding ambition, you can work towards this by being dedicatedly consumer driven. Identify a specific problem people within your target market face and work towards creating an effective solution for it. Take inspiration from your own experiences and inconveniences and research whether a satisfying product or service exists in the market that addresses it. Unicorns are efficient, focusing iterations on being cost-effective and including only the most essential components in early stages to seek feedback from consumers.

There is no one-size-fits-all solution, but these are key traits that help put startups on the right track.

What frequent mistakes do startups make in early stages?

It’s necessary for startups to lay strong foundations from the beginning. One of the things that make or break a business is the right set of stakeholders, including employees, strategic partners, and investors. Finances are understandably tight, especially in the early stages of setting up, but creating a strong team is an essential cost for long-term growth. Of course, it’s important to find people with the necessary skill set and expertise, but it’s equally as important to choose members whose drive and values match yours. Bring everyone on the same page so you can collaborate effectively to achieve growth in the long-term.

Another is to create a product or service without identifying what problem or challenge it helps solve. Conduct first-hand research of your audience and the challenges they face so you can develop solutions based on actual needs. Don’t forget to heed the feedback you receive and adjust your business model and user experience accordingly, even before launching. Follow up future iterations with the same feedback and improvement loop to ensure a desirable product

Finally, and perhaps most importantly, is being realistic about your goals and strategies. Be ambitious, be driven and aspire to succeed, but that comes with setting achievable goals for your business and remaining steadfastly dedicated to achieving sustainable growth and attracting investors. Fuel your passion to succeed and remain persistent – you might face setbacks in the journey but remain resilient. If after numerous iterations the feedback is still low, pivot and keep moving forward.

Incubators like ours play a pivotal role in helping young entrepreneurs and start-ups avoid the common pitfalls. We are committed to providing our members regular and up-to-date advisory in line with international best practices, as well as regional know-how, so they can make educated decisions for their future.

What must startups keep in mind as they prepare to scale their business?

Networking is essential for any business, whether you are an established organisation or just getting started. A large, strong network will aid you in finding potential investors, business partners and board members as well as industry leaders and C-Suite figures who can guide you and facilitate valuable opportunities for collaboration.

Businesses part of our incubator have the benefit of in5’s annual calendar of networking events and expert-led discussions to forge these critical relationships. We not only offer startups hundreds of hours of advisory and mentorship with a steering committee of representatives from some of the leading organisations in the world, but also nurture a community of future-minded businesses that can rely on each other for support at different stages of their journey. Plus, startups are located within larger business ecosystems such as Dubai Internet City, Dubai Design District and Dubai Production City, offering them unrivalled access to some of the biggest players in tech, design and media.

Another essential relationship is with your early customers and consumers. Heed their feedback, collate the data you gather from their experiences and adjust your product — their loyalty and endorsement can go a long way. Data is essential, especially in technology. Identify ways you can securely collect data from your users and let that guide how you pitch to investors, devise your marketing and traction plans, and move forward into proceeding growth phases.

Source:https://www.khaleejtimes.com/start-ups/star-tech-why-dubai-has-become-a-magnet-for-entrepreneurs

Dubai to enhance its position as a global liveability hub

Under the terms of the agreement, DET and HSBC will promote to HSBC customers and employees the unparalleled quality of life in Dubai, its position as a global investment hub and the diverse features of the destination that everyone can enjoy

Dubai’s Department of Economy and Tourism (DET) and HSBC Bank Middle East have signed a memorandum of understanding (MoU), paving the way for increased cooperation in further enhancing Dubai’s position as a global liveability destination.

Under the terms of the agreement, DET and HSBC will promote to HSBC customers and employees the unparalleled quality of life in Dubai, its position as a global investment hub and the diverse features of the destination that everyone can enjoy.

The MoU also envisages collaboration in marketing activities designed to promote events and experiences across the tourism ecosystem to further amplify the city’s position as a leading international business, leisure and events destination.

Issam Kazim, chief executive officer, Dubai Corporation for Tourism and Commerce Marketing; and Abdulfattah Sharaf, CEO of HSBC UAE and head of International, HSBC Bank Middle East Limited, signed the MoU.

“We are pleased to partner with HSBC, a global brand that has played a significant role in the development of Dubai’s business, banking and finance sectors, in showcasing our multi-faceted business and tourism offering,” Issam Kazim said.

“This MoU reflects the trust and confidence reposed in Dubai by multinational corporations and will further enhance our efforts to support the aim of our visionary leadership to make Dubai the most sought-after international city and the most attractive location to live and work in,” he said.

“Our partnership with HSBC is also testament to the continued efforts being made in collaboration with our stakeholders to leverage the city’s strategic location, world-class infrastructure and its position as one of the world’s safest destinations to attract multinationals, entrepreneurs, investors and tourists to Dubai,” Kazim added.

Abdulfattah Sharaf said: “Opening up a world of opportunity is our purpose at HSBC and it is what we have been doing every day for our customers in the UAE since we became the first bank to open our doors for business here more than 75 years ago.

“In that time the UAE has built itself into a global trade and logistics hub, an international financial market, a leader in Sustainable Finance, a magnet for innovation, and a focus of global wealth creation. HSBC has been with the UAE on every step of that journey and this MoU reflects our commitment to the future of the UAE and our ambitious plans for growth here.”

With an increasing number of international firms choosing Dubai as their base of operations, DET and HSBC will work closely to support these companies with the aim of making it easier for them to set up their business in the city.

DET and HSBC will further elevate the city’s standing as a global liveability hub by highlighting and promoting the initiatives launched by Dubai to ease barriers to entry for business and leisure travellers, as well as the long-term residency initiatives that have been launched to offer pathways for deeper engagement and longevity with Dubai.

These include the new visas and programmes such as Golden Visa targeting investors, entrepreneurs and specialised talents, the five-year multi-entry visa for employees of multinational companies, and the Virtual working and Retire in Dubai Programmes.

Source:https://www.khaleejtimes.com/business/dubai-to-enhance-its-position-as-a-global-liveability-hub