Application of corporate tax on the individuals and legal persons

If the individual is conducting any commercial activity which requires a licence from the related authorities, the individual would be required to take the permit, and the UAE source income of the individual would be subject to corporate tax

The persons subject to corporate tax (CT), can be classified into natural persons and legal persons. The natural persons who fulfil the criteria would fall under the scope of CT, and in the same way, the legal persons that satisfy the specific conditions would be subject to CT. On the other hand, natural and legal persons who do not meet the criteria would be exempt from CT. In this article, we have covered the proposed treatment of CT on natural persons and legal persons.

Application of CT on the natural person:

The individuals can conduct some activities in the UAE without taking a commercial licence/permit, and such income of individuals would not be subject to CT. For example, individuals’ employment income, dividend income, rental income from the investment in the property and other investment income.

If the investments in the real estate and other areas are held through a private or family trust on behalf of individual beneficiaries, the trust would be subject to the same CT treatment like for a natural person. If the individual family members own the property/properties, they can create trust and shift all their properties under the trust. The trust would be managing all such properties on behalf of the individuals who would be beneficiaries of the income. Such income of the trust will not be subject to CT.

Application of CT on the legal person:

The legal persons can be classified into incorporated persons like limited liability companies (LLC), public joint-stock companies (PJSC), private shareholding companies etc. and unincorporated persons like partnerships, joint ventures (JVs) and associations of persons (AoP). The incorporated persons may be incorporated in the UAE or out of the UAE. If the legal persons are incorporated in the UAE, their worldwide income will be subject to CT, and if the businesses are incorporated out of the UAE, still their income would be subject to CT in the UAE if these businesses:

• are being controlled and managed in the UAE (worldwide income will be subject to CT).

• have Permanent establishment in the UAE (UAE source income will be subject to CT)

• earn any UAE source income (UAE source income will be subject to CT)

Like incorporated persons, unincorporated persons like partnerships, JVs, and AoP may be in the UAE or out of the UAE. If these are in the UAE, businesses would be required to assess whether their partners have limited or unlimited liability. If any of the partners have unlimited liability, these entities are called “transparent” and their income would be subject to CT in the hands of the partners or members. This means that these entities will not be subject to CT but their net taxable income will be subject to CT in the hands of the partners or members. On the other hand, where the liability of all partners is limited, such partnerships will be treated like an incorporated company in the UAE.

If the partners or members are living in the UAE, and unincorporated persons are located out of the UAE, then some countries may treat them as “transparent” entities and others may treat them as a company. Such non-resident unincorporated persons will have the same CT treatment in the UAE like these will have in their respective countries.

The businesses and natural persons are required to assess their status and be prepared for the CT accordingly.

Source:https://www.khaleejtimes.com/finance/application-of-corporate-tax-on-the-individuals-and-legal-persons

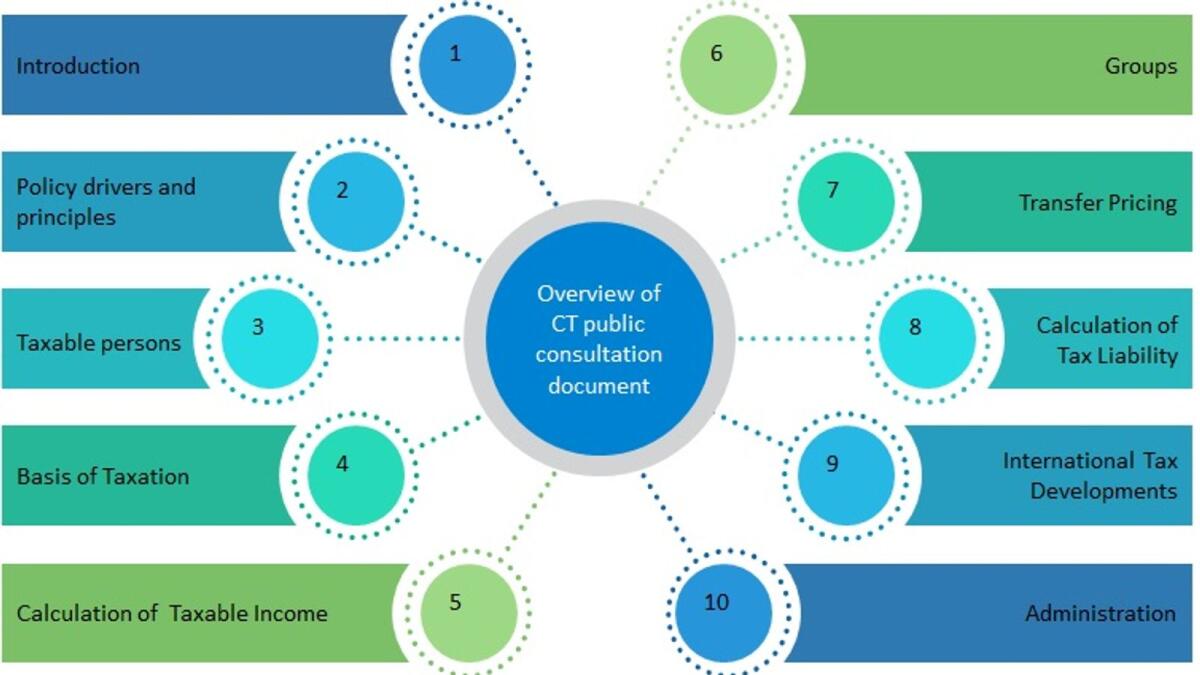

Overview of the corporate tax public consultation document

The consultation document is containing 10 sections starting from the introduction and ending with the administration

On January 31, 2022, the Ministry of Finance (MoF) announced that the UAE will introduce the corporate tax on the taxable profits of the businesses effective from the financial year starting on or after June 01, 2023. In continuation of the finalisation of the UAE corporate tax (CT) regime, on April 28, 2022, the MoF issued the public consultation document to seek the opinion of the stakeholders on the main features and smooth implementation of the corporate tax which would be helpful for the MoF to receive input from the interested parties and make informed decisions.

The consultation document is containing 10 sections starting from the introduction and ending with the administration. In the first and second sections of the consultation document, MoF has highlighted the purpose of issuing the consultation document and the rationale behind the issuance of CT regime in the UAE respectively.

• have Permanent establishment in the UAE (UAE source income will be subject to CT)

• earn any UAE source income (UAE source income will be subject to CT)

The tax on unincorporated partnerships, joint ventures and associations of persons depends upon their presence and liability of their partners.

The fourth section covers the definition of residents and non-residents. The legal persons incorporated in the UAE will automatically be considered residents. The foreign companies will be UAE residents if effectively managed and controlled in the UAE. The natural person who is engaged in business or commercial activity in the UAE will be a UAE resident. Anyone who is not a resident will be considered a non-resident. The residents are taxable in the UAE on their worldwide income and non-residents will be subject to tax in UAE on taxable income of their PE in the UAE and UAE sourced income.

The fifth section contains the approach to calculate the taxable income which states that financial statements profits calculated as per IFRS will be adjusted to arrive at the taxable income.

In the sixth section, it has been given that the UAE resident group of companies can form a tax group and be treated as a single taxable person. Moreover, it covers the conditions to enter into the tax group. The rules related to the transfer of losses, group relief and restructuring relief has been given in detail.

The seventh section highlights that there would be transfer pricing rules and transactions between the related parties would be on an arms-length basis. Arm length principles and documents requirement has been given in this section as well.

In the eighth section, it has been given that the zero per cent tax would be applicable on the taxable income up to Dh375,000, and any taxable income beyond Dh375,000 would be subject to tax at the rate of nine per cent. The zero per cent withholding tax would apply to the following domestic and cross border payments made by the UAE businesses:

• UAE sourced income earned by a foreign company that is not attributable to a PE in the UAE of that foreign company.

• Mainland UAE sourced income earned by a Free Zone Person that benefits from the zero per cent CT regime

• Dividends and other profit distributions made by a Free Zone Person that benefits from the zero per cent

TThe UAE and over 130 other countries reached an agreement on BEPS 2.0. The ninth section will cover the proposed approach by the UAE to respond to BEPS 2.0, and set the basis for the reallocation of profits from where sales arises and the requirement for the global minimum tax of fifteen per cent

A business subject to CT will need to register with the FTA and obtain a tax registration number. Every registered business will be required to file an annual tax return and make payment within nine months from the end of the relevant financial year, and it has been given in the last section of the public consultation document.

Source:https://www.khaleejtimes.com/finance/overview-of-the-corporate-tax-public-consultation-document?_refresh=true

What are deferred tax liabilities

Deferred tax liabilities are the amounts of corporate taxes payables in future periods

In our previous article titled “difference between accounting and taxable profits”, we established that the difference between accounting and taxable profits could be of permanent and temporary nature.

Moreover, we discussed that temporary differences, which create lower taxable profits in the current period, occur due to taxable temporary differences and ultimately, it creates deferred tax liabilities.

Deferred tax liabilities are the amounts of corporate taxes payables in future periods, and this arises due to the following factors:

• Taxable revenue is lower than accounting revenue due to taxable temporary differences.

• Taxable expenses are higher than accounting expenses due to taxable temporary differences.

The tax authorities may allow businesses to pay tax on lessor income than the income booked in the statement of comprehensive income, which leads to lower taxable profits. Like interest of Dh50,000 on fixed-term deposits accrued by the A Ltd which will be received at the end of the deposit term of five years. Tax authorities will not consider this accrued interest as an income while calculating taxable profits of the current period, and the taxable temporary difference will arise due to this interest income.

In the cases where taxable expenses are higher than the accounting expenses, the typical examples are prepayments, like three years rent of Dh120,000 paid in advance. In the accounting books, it will be amortised over three years at the rate of Dh40,000 per year, while tax authorities in various jurisdictions may follow a cash basis and can ask the registered business to treat full rental payment of Dh120,000 as allowable tax expense in the first year. So, in the current period, taxable expenses would be higher by Dh80,000 due to prepaid rent.

Source:https://www.khaleejtimes.com/finance/what-are-deferred-tax-liabilities

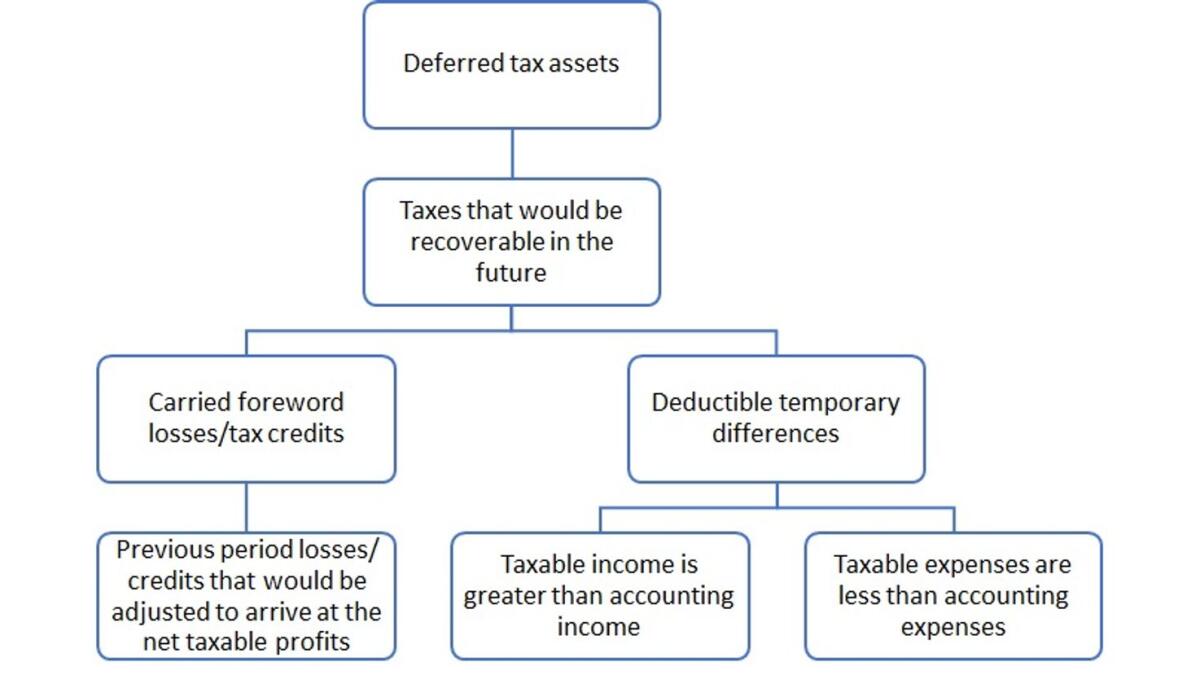

What are deferred tax assets

The tax authorities may ask businesses to pay tax on more income than the income booked in the statement of comprehensive income, which leads to more taxable profits

In our previous article titled “difference between accounting and taxable profits”, we established that the difference between accounting and taxable profits could be of permanent and temporary nature. Moreover, we discussed that temporary differences, which resulted in higher taxable profits, arose due to deductible temporary differences and ultimately, it would create deferred tax assets.

Deferred tax assets are the amounts of corporate taxes recoverable in future periods, and this arises do to the following factors:

• Taxable revenue is greater than accounting revenue due to deductible temporary differences.

• Taxable expenses are less than accounting expenses due to deductible temporary differences.

• The business has carried forward tax losses/tax credits

The tax authorities may ask businesses to pay tax on more income than the income booked in the statement of comprehensive income, which leads to more taxable profits. Like three years rent of Dh120,000 received in advance. In the accounting books, it will be amortised over three years at the rate of Dh40,000 per year, while tax authorities in various jurisdictions may follow a cash basis and can ask the registered business to treat full rental receipt of Dh120,000 as taxable income in the first year. [advances would not be subject to corporate tax in the UAE, so deferred revenue due to advances would not create any deductible temporary difference].

In the cases where taxable expenses are less than the accounting expenses, the typical examples are provision for warranties, bad debts, research and development costs, legal costs, etc. Registered businesses may book expenses on an estimated and/or provisional basis, while tax authorities may allow expenses on a cash basis. For example, A Ltd, based on the past experience, expects that three per cent of the total sales of Dh100,000 will be returned for repair in the next year and creates provision of Dh3,000 [100,000*3%]. This means A Ltd booked a liability for accrued product warranty costs by debiting expenses and crediting provision for the warranty. This provision for the warranty services may not be accepted by the tax authorities, and they may not allow related costs, which will lead to higher taxable profits, and it will become the basis for deferred tax assets.

The third reason for deferred tax assets, which will result in lower taxes in the future, is carried forwarded losses. Carried forward losses will be adjusted against the future taxable profits which will result in lower taxable profits and ultimately, it will lead to lower tax liability. The period over which losses can be carried forward vary from jurisdiction to jurisdiction, and we need to wait for the law for the exact period for which these losses can be carried forwarded.

International Financial Reporting Standards [‘IFRS’) states that deductible temporary differences are: “temporary differences that will result in amounts that are deductible in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled”.

Keeping in view the above definition of IFRS, in the aforesaid examples, rent of Dh80,000 and warranty of Dh3,000 are deductible temporary differences. The registered business will pay more tax in the current period due to these two factors. These amounts will be deductible in the future to ascertain the relevant period’s taxable profits.

IFRS with the few exceptions further states that: “a deferred tax asset shall be recognised for all deductible temporary differences to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised”.

Since deductible temporary differences are Dh83,000 [80,000+3,000], so the registered business will book deferred tax asset of Dh7,470 [83,000*9% (applicable corporate tax rate)] by assuming that future taxable profits would be available against which the deductible temporary difference will be utilised.

The period in which deductible temporary differences are greater than taxable temporary differences, in that period tax expense would be lower than the tax liability, and the differential will be booked as deferred tax asset in the statement of financial position. The period in which taxable temporary differences are higher than deductible temporary differences, in that period tax expense would be higher than tax liability and the differential will be booked as deferred tax liability which we will cover in our next article.

The above understanding is based on the global practices and requirements of IFRS 12. Once the UAE government introduces corporate law, it will set a clear basis for corporate tax computation.

Source:https://www.khaleejtimes.com/finance/what-are-deferred-tax-assets