How to compute taxable profits in the UAE

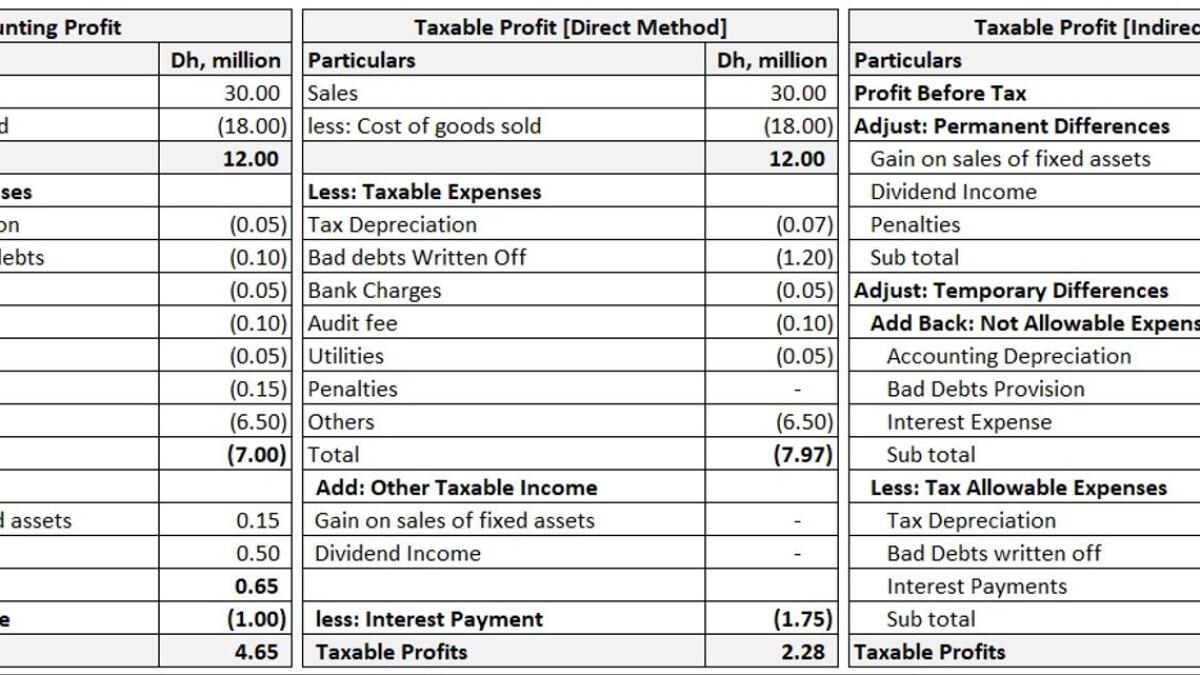

Under the direct method of calculating taxable profits, we can calculate the taxable profits directly by deducting the cost of goods sold, tax allowable expenses and other allowable deductions from the gross income of the corporations

Our previous article focused on the differences between accounting and taxable profits. We established that permanent differences and temporary differences lead to differences in accounting profits and taxable profits. We concluded that permanent differences are incurred in one period and do not impact the subsequent period. In comparison, temporary differences are incurred in one period and affect the following period.

In this article, we will learn how to compute taxable profits. There are two approaches to calculate taxable profits, and I am naming them as (i) Direct method and (ii) Indirect method.

Under the direct method of calculating taxable profits, we can calculate the taxable profits directly by deducting the cost of goods sold, tax allowable expenses and other allowable deductions from the gross income of the corporations. Taxable income, if any would be added to arrive at the taxable profits. So, we can say that:

“Taxable Profits = Gross Income – Cost of goods sold – Tax allowable expenses and deductions + Other taxable income.”

This is a straightforward method of calculating taxable profits, and it would be very effective if the corporations were not preparing the financials regularly.

In the indirect method, taxable profit can be calculated by making accounting profits as a base, adding back all disallowable expenses, deducting tax allowable expenses, adding taxable other income, and deducting non-taxable other income. For example, the equation would be as under:

Add: Disallowable expensesXXXX

Less: Tax allowable expensesXXXX

Add: Other taxable incomeXXXX

Less: Other nontaxable income XXXX

Taxable ProfitsXXXX

Companies and tax authorities prefer to use the indirect method to calculate taxable income. This is a very effective and reliable method to compute the corporate tax where corporations are preparing the financials regularly, and these financial statements are audited by external auditors. In addition, it’s quick to calculate taxable profit as accounting profits is taken from the audited financials, and the break of other numbers is available in the notes to the financial statements.

In both of the above methods, tax allowable expenses and income are based on the principles and rules defined in the corporate tax law and related regulations.

Example: ABC company has an annual income of Dh 30 million, and its cost of goods sold is Dh18 million. The company’s operative expenses are Dh7 million which includes: Accounting depreciation of Dh0.05 million while tax depreciation is Dh0.07 million; Provision for doubtful debts of Dh0.1 million while actual debts of Dh1.2 million has been written off; Bank charges Dh0.05 million, Audit fee Dh0.10 million, Utilities Dh0.05 million; Penalties Dh0.15 million, and Other expenses Dh6.5 million. The company sold a machine, and the gain was Dh0.15 million. ABC earned a dividend income of Dh0.5 million. ABC Interest expense is Dh1 million, while the actual interest payment is 1.75 million.

Solution: The diagram shows that the accounting profit before tax is Dh4.65 million while taxable profit is Dh2.28 million under both methods. Therefore, tax payable would be Dh0.21 million [Dh2.28*9 per cent].

While calculating the taxable profits, tax depreciation and bad debts written off have been allowed for tax purposes instead of accounting depreciation and provision of doubtful debts, which are not allowed for tax purposes. Penalties have not been allowed for tax purposes as an expense. Interest expense has been disallowed, while interest payment has been allowed for tax purposes. Dividend income and capital gain (gain on sale of fixed assets) are not subject to tax, so it has not been considered taxable income.

Dividend income, gain on fixed-assets sales, and penalties have created permanent differences. This means these will impact the current period, and it will not have any impact in the subsequent period. Depreciation, bad debts provision and interest have created temporary differences, and it would be offset in the following period. Both administrations have accepted bank charges, audit fees, utilities and other expenses as allowable expenses.

The above understanding is based on the global practices and press releases issued by the Ministry of UAE on corporate tax. Once introduced by the UAE government, the law and related regulations would set a clear basis for corporate tax computation.

Source:https://www.khaleejtimes.com/finance/how-to-compute-taxable-profits-in-the-uae

Key impacts of corporate tax on UAE businesses

Corporate tax would be the short-term liability of the businesses, which would adversely affect their working capital. Businesses would be required to assess the gap in the working capital, and they would bridge the gap

We all know that corporate tax (CT) would be effective from the financial years starting on or after June 01, 2023. All stakeholders have almost one and half years, but CT has become the talk of the town, and everyone is discussing and trying to figure out the impacts of CT on the businesses, individuals, government, and overall economy. In this article, we have assessed and analysed the impacts of CT on the key stakeholders.

Every registered business would be liable to register for CT and annually, they would be required to pay nine per cent of their adjusted taxable profits over and above the exemption threshold of Dh 375,000 so, CT would be the short-term liability of the businesses, which would adversely affect their working capital. Businesses would be required to assess the gap in the working capital, and they would bridge the gap. While preparing the budget for the respective period, companies would consider the impact of CT on the business, and they would plan the actions accordingly.

The groups which are operating in the UAE, would have an option to have single CT registration and adjust the losses of the group entities to arrive at the group taxable profits. For sure, the entities which are under common control and/or ownership would plan to go for restructuring like to change the ownership and/or control to opt-out the single CT registration, which would help them to adjust the losses of group entities and it will reduce their tax liability.

Loss-making groups or businesses would be able to carry forward their losses which would be adjusted against the future taxable profits so CT would not be considered a burden on loss-making Units.

Businesses having taxable income of up to Dh375,000 would not be subject to CT, which would incentivise start-ups and new businesses.

Alignment of the tax year with the financial year depends upon the timeline to submit the annual corporate tax return which would be announced in the law and/or the related regulations and the businesses would act accordingly.

The introduction of CT would involve implementation, training and bureaucratic compliance cost which would not be too high as the tax system is very simple in the UAE. This is certain that businesses would focus on tax planning to minimize the impact of CT on their profits which would increase the demand for tax professionals.

It’s highly likely that shareholders would try to maintain their share of profits, and they would pass on the impact of CT to the end-users in the form of increasing sales prices which would make things a little expensive for the end-users and have an adverse impact on their purchasing power. Reduction in the purchasing power would have an impact on the demand for goods and services and its trickle-down effect would be on the production and sales of the businesses which would affect the growth of the economy in the short run.

CT affects the decisions related to Foreign Direct Investment (‘FDI’), and it creates a wedge between the pretax and post-tax returns on FDI. Investors are always keen to know the direct taxes in the country in which they wanted to invest and taxes on the repatriation of profits. Since the rate announced by the government is highly competitive as compared to other countries, and double tax treaties are in place by the UAE government so, the introduction of CT would not have any major impact on FDI. Moreover, Free Zones would keep providing invectives to the businesses for a specific period as per their respective laws, so businesses will keep enjoying the benefits of the tax. Dividend and capital gains would not be subject to CT, so it would create attraction for the investor to invest in the UAE market.

As mentioned above, it’s highly likely that businesses would pass on the impacts of CT to individuals by increasing their prices, which would impact the purchasing power of the consumers. Employees would demand an increase in salaries to maintain their purchasing power. On an overall basis, goods and services would become slightly expensive for the end-users.

Globally, taxes are the major source of revenue for governments. Governments across the globe spend these taxes on the welfare of the public. In the same way, like VAT, CT would become another source of income for the Government of UAE and the UAE Government would spend this income for the welfare of the public by developing world-class infrastructure, hospitals, roads, medical facilities etc.

Moreover, it would reduce reliance on oil-generated money and lead to diversified sources of income for the Government which would be a sign of a healthy and matured economy.

Being its competitiveness, CT would have a nominal impact on the corporate savings and FDI, which would create an adverse impact on the growth of the country in the short run, but in the long run, it would develop the confidence of the investors which would lead to growth.

Keeping in view all the above, in nutshell, we can conclude that CT has been crafted to incentivize investment and keep transparency to meet global standards which would provide a stable society where businesses would contribute and add value for the growth of the economy.

Source:https://www.khaleejtimes.com/business/key-impacts-of-corporate-tax-on-uae-businesses

Corporate tax: A sign of a credible economy

Every business registered in the UAE, either on the mainland or in the free zone, would be liable to register for CT purposes

The Ministry of Finance of the UAE has made an announcement on January 31, 2022, for the implementation of federal corporate tax (CT) effective from the financial years starting on or after June 1, 2023, to cement its position as a world-leading hub for businesses and investments. The introduction of CT would be helpful to meet international standards to bring transparency and prevent harmful tax practices.

CT is already in place in four Gulf Cooperation Council countries, and the UAE is the fifth country that has joined the club. At the moment, there is no CT in Bahrain.

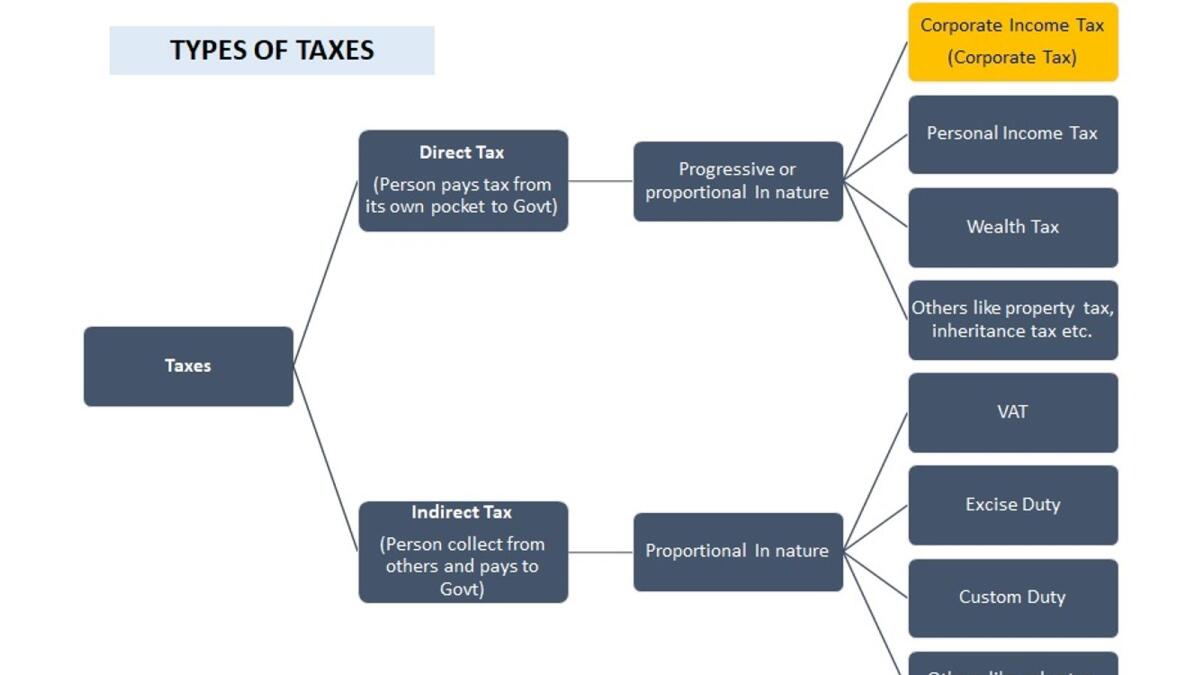

CT is a proportional direct tax (flat-rate tax) that applies to the adjusted taxable profits of the corporations. In some jurisdictions, this is called company tax or business tax. CT is different from the personal income tax which applies to the income of the individuals. CT is different from the value-added tax (VAT) as well which is an indirect consumption tax. CT is not a replacement for VAT, but both taxes would be in place at the same time.

Every business registered in the UAE (except companies involved in the extraction of natural resources), either on the mainland or in the free zone, would be liable to register for CT purposes, and they would be responsible to submit their annual CT return and pay the CT payment accordingly. The group companies, which are under common control and/or common ownership, would be able to get single CT registration, and they would be liable to submit a single return on an annual basis. This would be quite helpful for the group companies as the tax losses of group entities would be adjusted against the taxable profits of other entities of the same group which would reduce the tax base and ultimately, lead to lesser tax on their taxable profits.

To support small businesses and startups, zero per cent CT would be applicable on taxable income of up to Dh375,000, and any taxable income exceeding Dh 375,000 would be subject to tax at a flat rate of nine per cent. A different rate would be announced for the multinational entities that meet the criteria of pillar II companies according to the Organisation for Economic Cooperation and Development (‘OECD’) guidelines, which requires establishing a minimum level of taxation on multinational companies doing business around the world.

CT would not be applicable on the individuals’ income from salaries, real estate, investment in shares or other personal income not related to the UAE trade or business. However, if the individuals have taken the business licence and conducting commercial activity even as a freelancer, they would be liable to register, and their taxable income would be subject to tax based on the aforesaid criteria.

Foreign investors who do not carry on the business in the UAE, would not be subject to corporate tax. Advances would not be subject to CT, and the companies would be able to carry forward their losses up to a certain period, and the Laws and related Regulations would provide more detail about this. Withholding tax would not be applicable on the local and cross border transactions which would be helpful for the UAE to maintain its position as a global hub for businesses. There would not be CT on the capital gain (gain on the sales of the capital assets) and dividend received by the UAE businesses from their foreign investments.

There are more than 40 free zones in the UAE, and each free zone has its own framework. Based on these frameworks, the income of the businesses is not subject to corporate tax for a specific period. According to the press release, free zone businesses that meet all necessary requirements would continue to benefit from the corporate tax incentives. The companies which engage in the extraction of natural resources would be exempt from the CT but on these companies, respective Emirates Law would be applicable.

CT would apply to the adjusted taxable profits. Businesses would be required to prepare the financials as per applicable International Financial Reporting Standards (IFRS), and these financials would require adjustments to arrive at the taxable profits. The mapping of accounting numbers into tax numbers is always a challenging exercise since the basis of preparation of financial statements as per IFRS are different from the requirement of tax authorities. Like IFRS follows an accrual basis while tax authorities usually follow a cash basis. CT Law and related Regulations would provide a detailed understanding of the adjustments and exemptions available to arrive at the taxable profits.

Businesses would be required to have proper impact assessment and they would be required to tweak their processes for the proper incorporation of CT in the organization. Companies need to train their staff and calculate the impact on their working capital. Profit shifting through non-arm’s length pricing would have an impact on the tax base which would affect the tax amount, so transfer pricing rules would be required to be implemented properly. Compliance and operating costs of the businesses would go up, but it would bring more transparency and credibility to their results.

Source:https://www.khaleejtimes.com/finance/corporate-tax-a-sign-of-a-credible-economy

What are the major impacts of VAT

In this article, KT has assessed the impact of VAT on businesses, individuals, government and overall economy

Since VAT is a consumption and multistage tax, so it has an impact on each player of the supply chain and individuals, who are buying the goods and services for consumption purposes. It has an effect on the economy and it is a major source of revenue for the government. In this article, we have assessed the impact of VAT on businesses, individuals, government and overall economy.

(a) Impact of VAT on businesses

There are some common impacts of VAT on each business and some specific impacts, based on the categories of supplies.

(i) Common Impacts of VAT on Businesses

Whenever VAT is being introduced in any country, every business is required to have an impact assessment to assess the impact of VAT. Based on the impact assessment, they will be able to know, on which areas of business VAT will have an impact and what are they required to do to implement it properly. Like based on the impact assessment, they will be able to adopt the proper tax position of their supplies. Businesses will be able to know eligibility of VAT registration, impact on their working capital and system, required changes in the processes, compliance requirement etc.

Based on the impact assessment, businesses are required to implement the VAT properly which requires changes in the system, tweaking existing processes, training to the employees, communication with the suppliers and customers etc.

Once the VAT is up and running, businesses are required to submit the VAT Return, and while submitting the VAT returns, businesses cannot claim input tax on some purchases/expenses like expenses for throwing parties, expenses related to Car which can carry less than 10 people and is available for personal use, expenses related to the dependents of the employees where companies have no legal obligations, non-business expenses etc. All such blocked input tax will become cost of the businesses.

Businesses requires work force to comply VAT so it will lead to increase in administration and hiring cost. Sometime, companies are required to hire consultants which will lead to increase the consultancy charges.

(ii) Specific impact of VAT on businesses

So far as specific impact of VAT is concerned on businesses based on the categories of supplies, the industries that are dealing with standard rated supplies, VAT will impact the purchasing power of their customers and it will have a negative effect on the demand of their supplies. VAT registered companies which have longer payment terms with the customers and shorter payment terms with the suppliers, VAT will have adverse impact on their working capital, and vice versa.

Businesses which are dealing with the exempt supplies, like local passenger’s transport, banks and financial institutions offering margin-based services, suppliers of bare land etc will not be able to claim related input tax and such input tax will become their cost which will lead to increase in the operating cost of the business. Most probably, such businesses will pass on this cost to their customers by increasing the prices of their supplies to achieve their targeted margins so it will have a negative impact on the purchasing power of their customers which will affect demand of their supplies.

Businesses that are dealing with zero rated and out of scope supplies, VAT will not have any major impacts on them except the common impacts as mentioned above.

(b) Impact of VAT on individuals

Individuals who are buying standard rated goods and services for consumption purposes, they would be liable to pay five per cent VAT, and Individuals who are buying VAT exempt goods and services, most probably, they would be liable to pay higher prices. Such purchases will have a negative impact on their purchasing power. However, if they are buying zero rated or out of scope supplies, they wouldn’t be liable to pay any VAT and/or increased price which will not have impact on them.

(c) Impact of VAT on the government

Globally, taxes are the major source of revenue for the Governments and Governments across the globe spend these taxes for the welfare of the public. In the same way, VAT has become a source of income for the Government of United Arab Emirates (UAE) and UAE Government spends this income for the welfare of the public by developing world-class infrastructure, hospital, roads, medical facilities etc.

Moreover, VAT has reduced reliance on the oil-generated money and led to diversified sources of income for the Government which is a sign of healthy and matured economy.

(d) Impact of VAT on the economy

I am always saying, this is not only introduction of VAT, but the documentation of the whole economy. Government will be able to know the sales and purchases of each registered supplier in the supply chain, which would be helpful for the Government to take decisions.

Moreover, standard rated and exempt supplies of goods and services will make supplies more expensive and it will push the inflation rate up based on average supply of standard rated goods and services in the market.

Source:https://www.khaleejtimes.com/business/what-are-the-major-impacts-of-vat