10 May

Compliance of economic substance regulations is a must to avoid penalties

Non-compliance with the ESR is subject to penalties ranging from Dh20,000 to D400,000. To avoid this, it is recommended that the licensee must comply with the ESR.

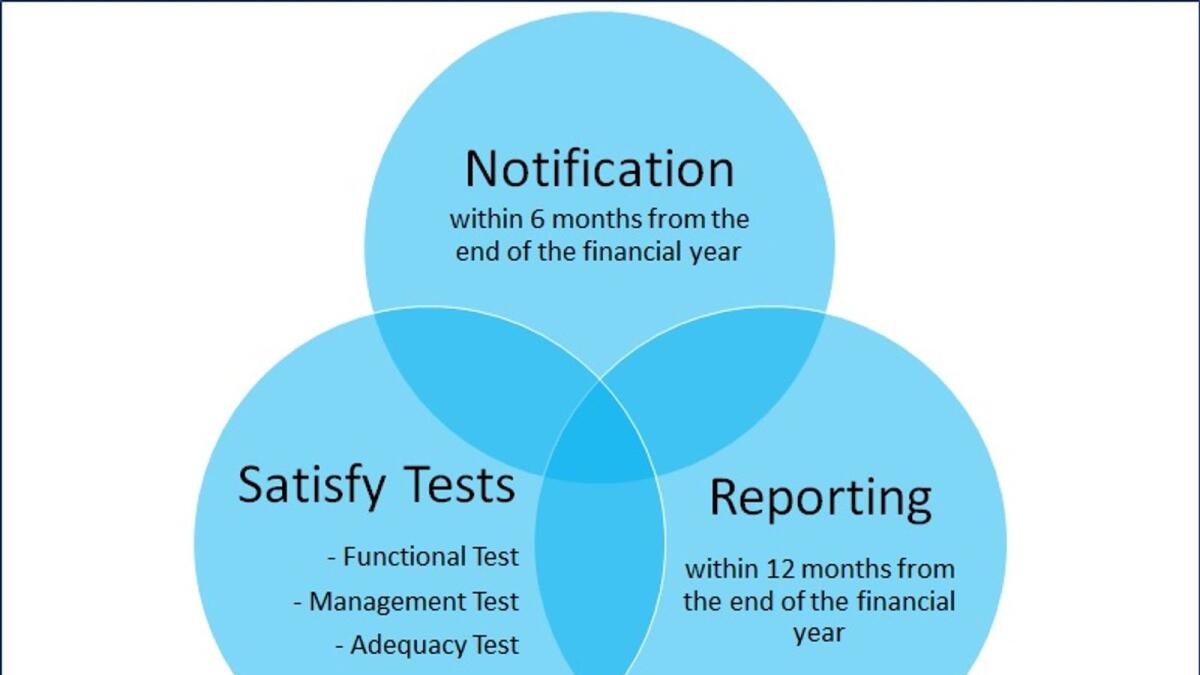

As discussed in our previous article, every licensee who earns relevant income from a relevant activity should submit notification within six months from the end of the relevant financial year, satisfy the economic substance test and submit the report within twelve months from the end of the relevant financial year.

The term licensee, with certain exceptions, means a juridical person (a legal entity — incorporated inside or outside the state); or an unincorporated partnership registered in the state, including a free zone and financial free zone, and conducts relevant activity.

The term relevant income means all gross income from a relevant activity recorded in the books of the licensee, and the word relevant activity means any of the nine specific activities mentioned in our previous article which we will discuss in detail in the future.

ESR notification

The notification is required to be submitted within six months from the end of the relevant financial year. The notification requires some basic information like licensee name, commercial license number, regulatory authority, legal status, information about the relevant activity, ownership and ultimate ownership, parent company and ultimate parent company etc. of the licensee. The notification requires to be submitted online on the Ministry of Finance (MoF) portal. As far as information about the relevant activity is concerned, the license is required to acknowledge relevant activity/activities executed by the licensee, and acceptance about the relevant income earned during the reportable period. The reporting of the financial numbers is not required in the notification but acknowledgement/acceptance of the relevant activity and relevant income.

ESR testing

The licensee is required to comply with the (i) functional test, (ii) management test and (iii) adequacy test. The licensee who earns relevant income from the relevant activity is compulsorily required to comply with these tests.

The functional test requires that the licensee conducts Core Income-Generating Activity/Activities (CIGA) in the State. If the CIGA is being conducted out of the United Arab Emirates (UAE), the licensee would be considered non-compliant, and it would attract penalties accordingly. Compliance with this test is not required in the case of holding company relevant activity. This means, that the CIGA related to the purely holding company business can be conducted out of the UAE, and it would not be considered non-compliance.

The management test demands that the licensee is being directed and managed in the UAE. The direction and management require that there should be adequate (at least one) board meeting in the UAE in a year. In the board meeting, there should be a full quorum and directors should be physically present. If the licensee is managed by its shareholders/owners/partners, then these requirements will be fully applicable possible to the manager/managers.

Moreover, the law demands that minutes of the meeting should be taken and should be in writing. The minutes should be signed by all directors attending the meetings. The minutes record the making of strategic decisions taken in the meeting. Minutes of all board meetings and related records should be kept in the UAE. The ESR law requires that the directors of the licensee have the necessary knowledge and expertise to discharge their duties.

Under the adequacy test, the licensee must have (i) adequate employees, (ii) adequate operating expenditures, and (iii) adequate physical assets. The law requires that the licensee or the third party to whom work has been outsourced must have an adequate number of qualified full-time employees who are physically present in the UAE. The employee can be employed by the licensee or third party, temporary contract, or long-term contract.

Moreover, the law requires that the licensee or third party to whom work has been outsourced must have adequate operating expenditure in the state. To comply with the law the licensee or third party must have adequate physical assets in the state. The physical assets include offices or business premises, and such premises may be owned or leased by the licensee.

ESR report

As mentioned above, the licensee is required to submit the report within 12 months from the end of the relevant financial year. The report is required to be submitted on the MoF portal. In the report, along with the basic information, the licensee is required to provide the financial information like the amount of revenue earned from the relevant activity/activities, number of employees, number of meetings etc. that we will discuss in detail in our next articles.

Non-compliance with the ESR is subject to penalties ranging from Dh20,000 to D400,000. To avoid this, it is recommended that the licensee must comply with the ESR.

Source:https://www.khaleejtimes.com/finance/compliance-of-economic-substance-regulations-is-a-must-to-avoid-penalties