08 Feb

Corporate tax: A sign of a credible economy

Every business registered in the UAE, either on the mainland or in the free zone, would be liable to register for CT purposes

The Ministry of Finance of the UAE has made an announcement on January 31, 2022, for the implementation of federal corporate tax (CT) effective from the financial years starting on or after June 1, 2023, to cement its position as a world-leading hub for businesses and investments. The introduction of CT would be helpful to meet international standards to bring transparency and prevent harmful tax practices.

CT is already in place in four Gulf Cooperation Council countries, and the UAE is the fifth country that has joined the club. At the moment, there is no CT in Bahrain.

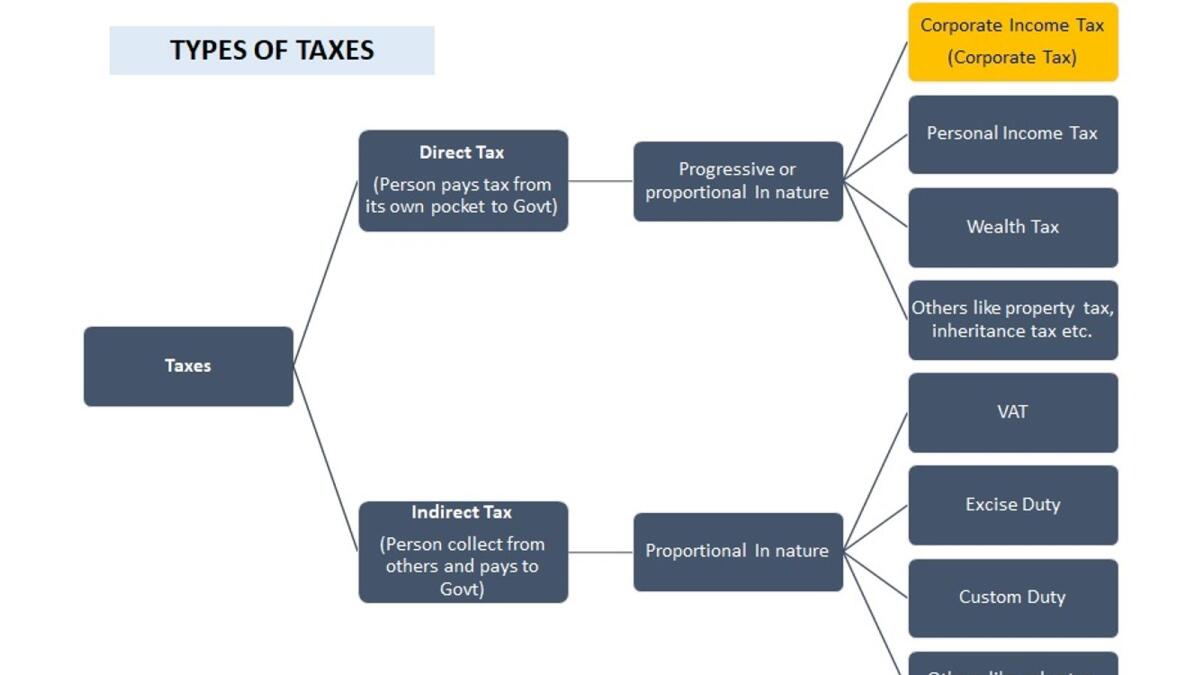

CT is a proportional direct tax (flat-rate tax) that applies to the adjusted taxable profits of the corporations. In some jurisdictions, this is called company tax or business tax. CT is different from the personal income tax which applies to the income of the individuals. CT is different from the value-added tax (VAT) as well which is an indirect consumption tax. CT is not a replacement for VAT, but both taxes would be in place at the same time.

Every business registered in the UAE (except companies involved in the extraction of natural resources), either on the mainland or in the free zone, would be liable to register for CT purposes, and they would be responsible to submit their annual CT return and pay the CT payment accordingly. The group companies, which are under common control and/or common ownership, would be able to get single CT registration, and they would be liable to submit a single return on an annual basis. This would be quite helpful for the group companies as the tax losses of group entities would be adjusted against the taxable profits of other entities of the same group which would reduce the tax base and ultimately, lead to lesser tax on their taxable profits.

To support small businesses and startups, zero per cent CT would be applicable on taxable income of up to Dh375,000, and any taxable income exceeding Dh 375,000 would be subject to tax at a flat rate of nine per cent. A different rate would be announced for the multinational entities that meet the criteria of pillar II companies according to the Organisation for Economic Cooperation and Development (‘OECD’) guidelines, which requires establishing a minimum level of taxation on multinational companies doing business around the world.

CT would not be applicable on the individuals’ income from salaries, real estate, investment in shares or other personal income not related to the UAE trade or business. However, if the individuals have taken the business licence and conducting commercial activity even as a freelancer, they would be liable to register, and their taxable income would be subject to tax based on the aforesaid criteria.

Foreign investors who do not carry on the business in the UAE, would not be subject to corporate tax. Advances would not be subject to CT, and the companies would be able to carry forward their losses up to a certain period, and the Laws and related Regulations would provide more detail about this. Withholding tax would not be applicable on the local and cross border transactions which would be helpful for the UAE to maintain its position as a global hub for businesses. There would not be CT on the capital gain (gain on the sales of the capital assets) and dividend received by the UAE businesses from their foreign investments.

There are more than 40 free zones in the UAE, and each free zone has its own framework. Based on these frameworks, the income of the businesses is not subject to corporate tax for a specific period. According to the press release, free zone businesses that meet all necessary requirements would continue to benefit from the corporate tax incentives. The companies which engage in the extraction of natural resources would be exempt from the CT but on these companies, respective Emirates Law would be applicable.

CT would apply to the adjusted taxable profits. Businesses would be required to prepare the financials as per applicable International Financial Reporting Standards (IFRS), and these financials would require adjustments to arrive at the taxable profits. The mapping of accounting numbers into tax numbers is always a challenging exercise since the basis of preparation of financial statements as per IFRS are different from the requirement of tax authorities. Like IFRS follows an accrual basis while tax authorities usually follow a cash basis. CT Law and related Regulations would provide a detailed understanding of the adjustments and exemptions available to arrive at the taxable profits.

Businesses would be required to have proper impact assessment and they would be required to tweak their processes for the proper incorporation of CT in the organization. Companies need to train their staff and calculate the impact on their working capital. Profit shifting through non-arm’s length pricing would have an impact on the tax base which would affect the tax amount, so transfer pricing rules would be required to be implemented properly. Compliance and operating costs of the businesses would go up, but it would bring more transparency and credibility to their results.

Source:https://www.khaleejtimes.com/finance/corporate-tax-a-sign-of-a-credible-economy