08 Mar

What are deferred tax assets

The tax authorities may ask businesses to pay tax on more income than the income booked in the statement of comprehensive income, which leads to more taxable profits

In our previous article titled “difference between accounting and taxable profits”, we established that the difference between accounting and taxable profits could be of permanent and temporary nature. Moreover, we discussed that temporary differences, which resulted in higher taxable profits, arose due to deductible temporary differences and ultimately, it would create deferred tax assets.

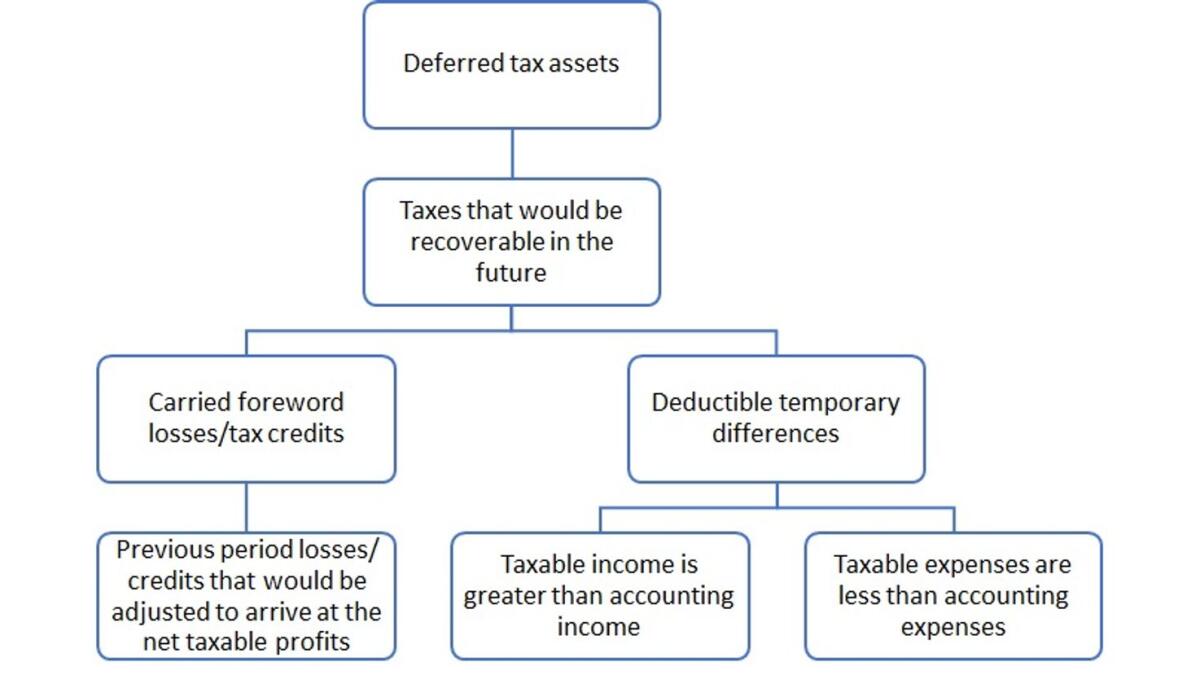

Deferred tax assets are the amounts of corporate taxes recoverable in future periods, and this arises do to the following factors:

• Taxable revenue is greater than accounting revenue due to deductible temporary differences.

• Taxable expenses are less than accounting expenses due to deductible temporary differences.

• The business has carried forward tax losses/tax credits

The tax authorities may ask businesses to pay tax on more income than the income booked in the statement of comprehensive income, which leads to more taxable profits. Like three years rent of Dh120,000 received in advance. In the accounting books, it will be amortised over three years at the rate of Dh40,000 per year, while tax authorities in various jurisdictions may follow a cash basis and can ask the registered business to treat full rental receipt of Dh120,000 as taxable income in the first year. [advances would not be subject to corporate tax in the UAE, so deferred revenue due to advances would not create any deductible temporary difference].

In the cases where taxable expenses are less than the accounting expenses, the typical examples are provision for warranties, bad debts, research and development costs, legal costs, etc. Registered businesses may book expenses on an estimated and/or provisional basis, while tax authorities may allow expenses on a cash basis. For example, A Ltd, based on the past experience, expects that three per cent of the total sales of Dh100,000 will be returned for repair in the next year and creates provision of Dh3,000 [100,000*3%]. This means A Ltd booked a liability for accrued product warranty costs by debiting expenses and crediting provision for the warranty. This provision for the warranty services may not be accepted by the tax authorities, and they may not allow related costs, which will lead to higher taxable profits, and it will become the basis for deferred tax assets.

The third reason for deferred tax assets, which will result in lower taxes in the future, is carried forwarded losses. Carried forward losses will be adjusted against the future taxable profits which will result in lower taxable profits and ultimately, it will lead to lower tax liability. The period over which losses can be carried forward vary from jurisdiction to jurisdiction, and we need to wait for the law for the exact period for which these losses can be carried forwarded.

International Financial Reporting Standards [‘IFRS’) states that deductible temporary differences are: “temporary differences that will result in amounts that are deductible in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled”.

Keeping in view the above definition of IFRS, in the aforesaid examples, rent of Dh80,000 and warranty of Dh3,000 are deductible temporary differences. The registered business will pay more tax in the current period due to these two factors. These amounts will be deductible in the future to ascertain the relevant period’s taxable profits.

IFRS with the few exceptions further states that: “a deferred tax asset shall be recognised for all deductible temporary differences to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised”.

Since deductible temporary differences are Dh83,000 [80,000+3,000], so the registered business will book deferred tax asset of Dh7,470 [83,000*9% (applicable corporate tax rate)] by assuming that future taxable profits would be available against which the deductible temporary difference will be utilised.

The period in which deductible temporary differences are greater than taxable temporary differences, in that period tax expense would be lower than the tax liability, and the differential will be booked as deferred tax asset in the statement of financial position. The period in which taxable temporary differences are higher than deductible temporary differences, in that period tax expense would be higher than tax liability and the differential will be booked as deferred tax liability which we will cover in our next article.

The above understanding is based on the global practices and requirements of IFRS 12. Once the UAE government introduces corporate law, it will set a clear basis for corporate tax computation.

Source:https://www.khaleejtimes.com/finance/what-are-deferred-tax-assets